The delay of the new round of Trump tariffs on some imports from September to December gave rise to various rumors about the genuine reasons for this decision. We can divide them into two types. The first type boils down to an assumption that Trump “blinked first” in the confrontation and de-escalation is coming on more favorable conditions for China. The second type of speculations come down to the search for objective grounds, in particular, in identifying a potential conflict of the tariffs with the US consumer, or more precisely with his pocket. And there is such a reason – the shopping season is in November and December.

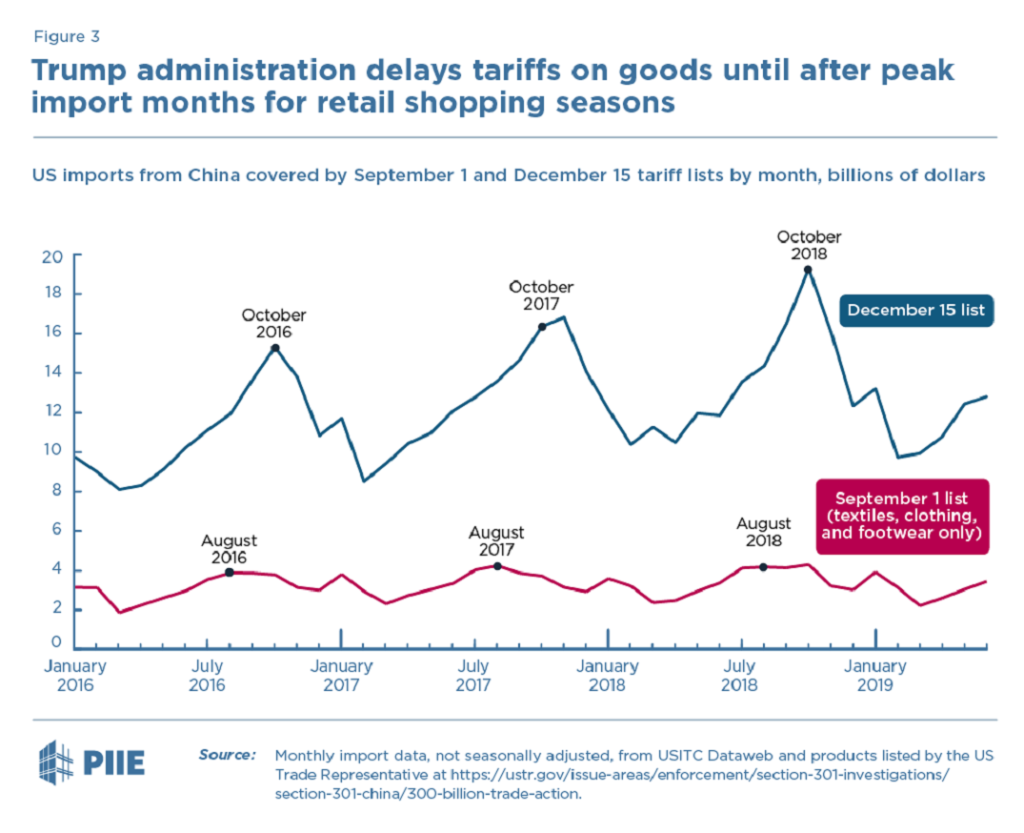

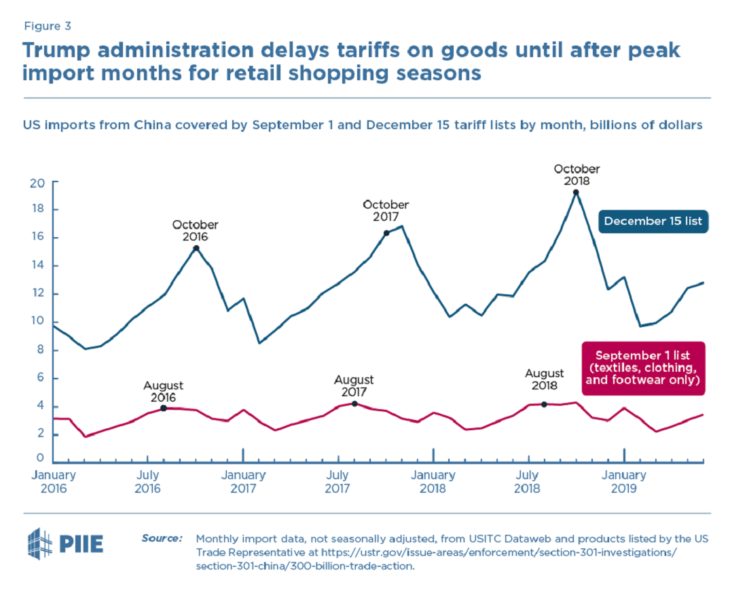

Recall that on August 13, the USTR released a plan for introducing new tariffs. Tariffs for 112 billion dollars will come into effect on September 1, and on December 15 another 160 billion dollars of imports from China will fall under the millstones of the tariff war. The administration’s initial plan was even harsher – to tariff almost the entire remainder of imports ($ 274 billion) on September 1. As we could expect, the way how USTR split initial tariff list into two parts provided us with some curious facts about why the administration allowed for the delay.

But first about the conceptual reasons for the decision. In the most primitive interpretation, the reasons for the tariff delay can be expressed in three points:

- The risk of a spike in inflation – price increases due to tariffs overlap with the seasonal surge in consumer spending (shopping season).

- The “boost” in economic activity from the seasonal uptick in consumption, which can be missed (not fully realized) due to a jump in inflation and a blow to consumer sentiments. And we know that the US economy needs that boost, especially with current fears of impending recession.

- As a result, political risk before the presidential election. The Trump administration cannot allow such a stupid miscalculation.

Take Christmas and the December holidays, for example. The peak of replenishment of warehouses with toys and consumer electronics for sale on Black Friday and Cyber Monday falls on October. Interestingly, if you look at the tariff list (the one of $160 billion for December 15), the peak of imports of goods from it also falls in October. In other words, peak October imports won’t feel the inflation pressure from tariffs because they will likely be introduced later, in December.

At the same time, the peak of import of goods in the list of 112 billion dollars (the first one on the line) falls on August, that is, it will have passed before September tariffs are introduced.

This can hardly be called a surprise if all the previous rounds of tariffs avoided consumer goods and their share in the tariff list will prevail in the last proposed round. But how the total tariff list was divided into two, and what dates were determined for the introduction of tariffs on the first list and on the second, clearly explain the purpose of the delay.

Obvious conclusion: Trump did not “blink”, and the warming of relations initiated by the US won’t likely to materialize. It seems to me that this is why the market, having studied the details, quickly shrugged off from the effect of positive news, entering into sell-off again.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.