Trade Wars Impacting Oil Prices

It’s been another turbulent week for oil prices which have made sharp moves in both directions as the market struggles to get to grips with the dynamic environment driving short term price action. Earlier in the week, crude prices had traded sharply to the upside as the US Trade Representative unexpectedly issued a statement noting that a portion of the goods due to fall under fresh 10% tariffs from September 1st, will now be exempt until December 15th for “health, safety, national security and other factors”.

The news was welcomed by traders given the heavy risk off tone to trading over recent weeks following Trump announcing the new 10% tariffs. The initial announcement was quickly followed by a reaction from China which sharply devalued the Yuan, sending USDCNH over 7 for the first time since the global financial crisis in 2008. This was met by the US Treasury Dept issuing a statement labelling China a currency manipulator.

Yields Pointing To US Recession

The announcement that tariffs will be delayed on some goods fuelled optimism that trade talks will continue, following earlier fears that they would be abandoned in light of this fresh escalation. However, following some initial relief, equities price and subsequently oil prices, began to roll over once again as risk aversion crept back in as fears of a global recession emerged. Yields on US 2Y treasuries, rose above 10Y treasury yields for the first time since 2007, such an occurrence has typically preceded a recession. Indeed, fears of a recession in Europe have also been heightened this week following data which showed Germany GDP contracting in Q2, putting the eurozone’s second largest economy on the brink of a recession for the first time since the global financial crisis.

EIA Crude Stores Rise

Crude came under further pressure mid week as the latest report from the EIA highlighted another build in US crude stores. The report from the Energy Information Administration covering the week ending August 9th showed that US crude inventories rose by 1.6 million barrels over the week. This lift, which was in stark contrast to the 2.8 million barrel decrease forecasted, marks the second consecutive week of inventory increases.

Gasoline Stores fall

Despite the rise in crude stores, the data showed that gasoline inventories were down by 1.4 million barrels over the week, undershooting analysts expectations of a 25k barrel increase. Distillate stockpiles, which include heating oil and diesel, were also down by 1.9 million barrels over the week, again undershooting analyst forecasts of a 1 million barrel increase.

Demand Outlook Concerns Remain

The rise in US crude stores comes at a difficult time given the ongoing tensions between the US and China, as well as growing fears of a global recession, which are casting doubt over the demand outlook heading into next year. In the short term it seems that the only factor likely to be able to properly support crude would be news of solid progress in US China trade talks, though this seems to be wishful thinking for now and the situation remains volatile and susceptible to sudden change.

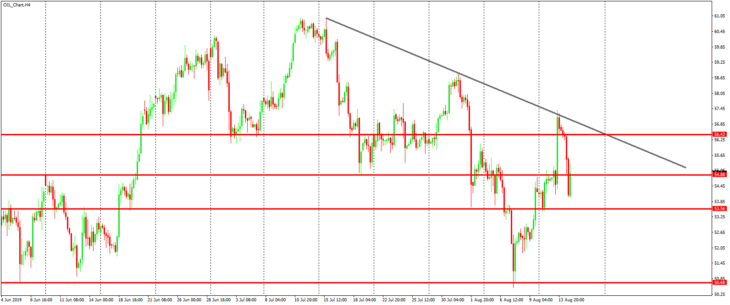

Technical Perspective

The rally in crude this week broke briefly above the 56.43 level but was ultimately capped by the bearish trend line from July highs. Price has subsequently moved sharply lower breaking beneath support at the 54.88 level and putting focus on further downside. 53.56 is the next support level to watch, a break of which will open the way for a run back down to the 50.68 lows.