On Monday morning, the USD got under pressure due to last Friday’s catalysts, but as investors are assessing external risks, their interest in “safe haven” assets are increasing.

At the end of the last week, the FOMC member Richard Clarida commented that the regulator might reduce the benchmark rate in case the US economy showed signs of slowing down. This comments again made market players think that the chances of the rate reduction were higher than raising it or keeping intact. As a natural result, they started selling “greenback”.

However, today’s trading session is obscured by the clouds that came last week. China put buying soy from the USA on hold as tariff war escalates. As peaceful as China usually is, this move may be considered as China’s intentions to attack. This, in its turn, means that market players will require “safe haven” assets to hide from the “storm”. In this light, the USD managed to recover.

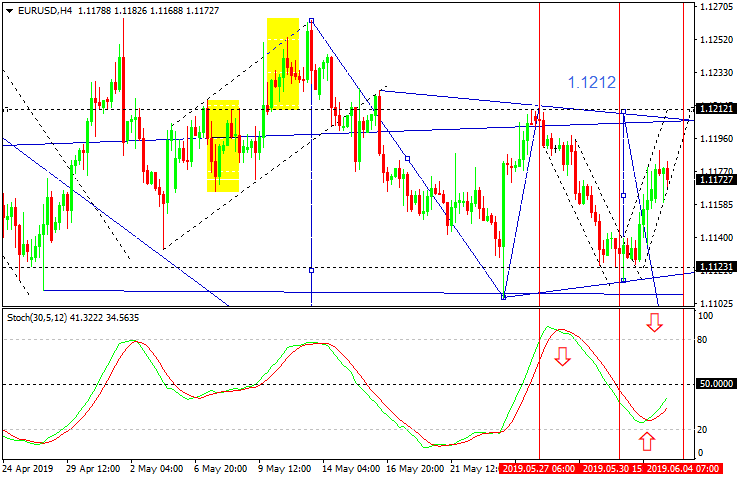

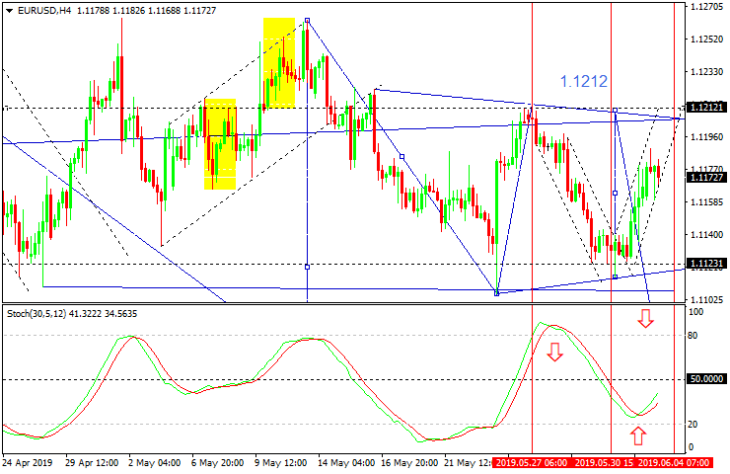

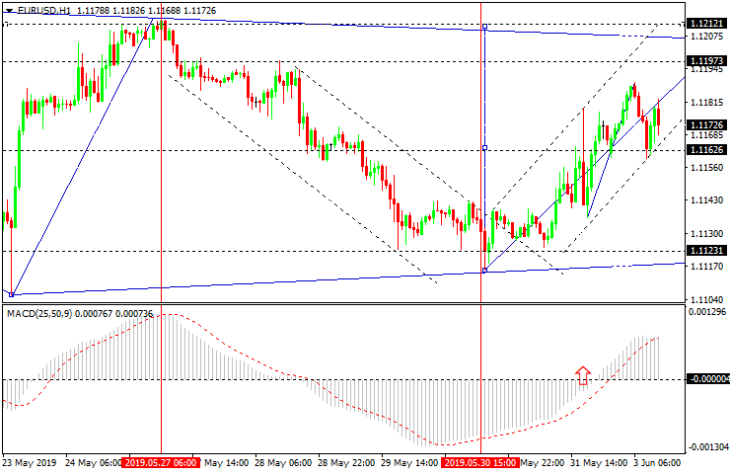

EURUSD charts

As we can see in the H4 chart, EURUSD has completed anther descending wave at 1.1122. Possibly, the pair may grow to return to 1.1212. In fact, the price is still consolidating below this level and right now is growing to reach it. If later the price breaks this level to the downside, the instrument may resume falling to break 1.1122 and then continue trading inside the downtrend with the short-term target at 1.1033. From the technical point of view, this scenario is confirmed by Stochastic Oscillator, as its signal line is reversing away from the “oversold area”, thus indicating another possible attempt of the price to reach 1.1212.

In the H4 chart, EURUSD is moving upwards. Right now, it is trading above 1.1162 and may form one more ascending structure towards 1.1212. After reaching it, the instrument may resume falling towards the downside border of the range at 1.1122. From the technical point of view, this scenario is confirmed by MACD Oscillator, as its signal line is moving above 50, which means a further growth towards 1.1212. After reaching this level, the pair may start a new descending wave with the target at 1.1122.

Read more

https://fortraders.org/en/forex-forecasts-analysis/is-it-too-late-to-buy-bitcoin.html

https://fortraders.org/en/forex-forecasts-analysis/oil-prices-extend-losses-amid-tension-between-mexico-u-s.html