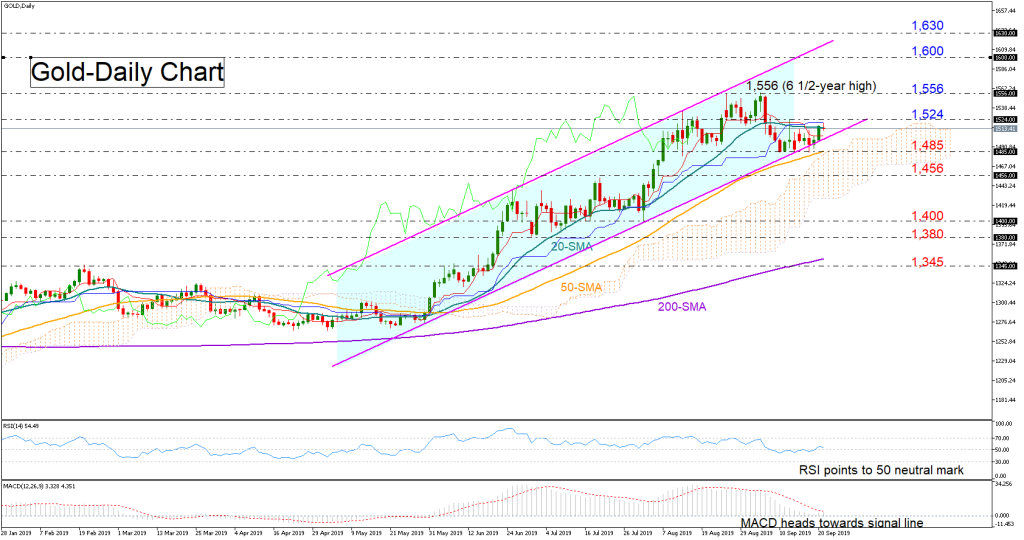

Gold managed to close slightly positive and above the 1,500 mark last week thanks to Friday’s rebound which found support around the bottom of the 4 ½-month old ascending channel.

In the short-term, the precious metal could follow a sideways path as long as the RSI holds around its 50 neutral mark and the MACD fluctuates near its red signal line.

Besides the lower boundary of the channel, traders will be closely watching the 1,485 handle where the market seems to have created a floor. A forceful move below that barrier could meet an obstacle near 1,456, while a drop under the Ichimoku cloud see a retest of the 1,400-1,380 area.

On the upside, a potential upturn could initially pause around the 1,524 resistance and before all eyes turn to the 6 ½ -year high of 1,556 registered on September 3. Should the bulls clear that peak, the upper line of the channel currently seen between 1,600-1,630 will attract a greater interest, while on top of that the bulls could take a rest near 1,685 before a bigger battle starts around 1,750.

In the medium-term picture, the precious metal maintains an upward pattern, keeping sentiment positive. The rising 50-day simple moving average (SMA), which continues to deviate above the 200-day SMA, is also an encouraging sign that the outlook will remain bullish for now.

Summarizing, gold is expected to trade neutral in the short-term and hold positive in the medium-term.