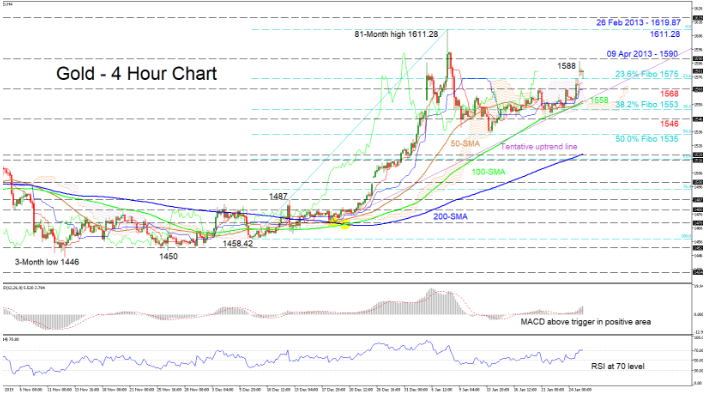

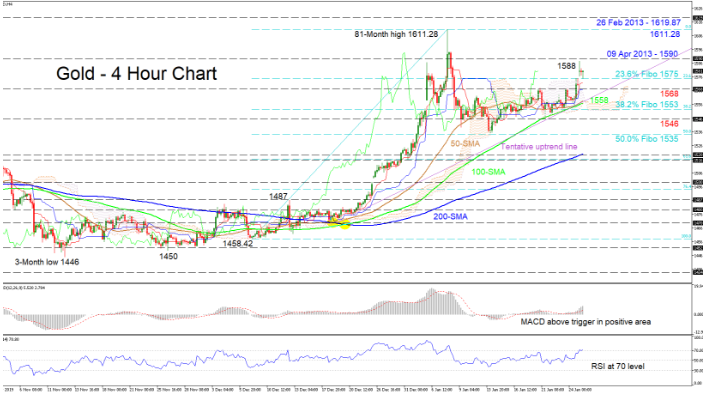

Gold seems to be taking a breather around the 1,575 level, which is the 23.6% Fibonacci retracement of the up leg from 1,458.42 to 1,611.28 after bouncing off the joined 50- and 100-period simple moving averages (SMAs). This view is also reflected in the Ichimoku lines, which are currently flat.

The short-term oscillators suggest a pause in momentum but lean towards the positive picture. The MACD is rising above its red trigger line in the positive zone, while the RSI is at its 70 overbought mark. That said, the tentative uptrend line and all ascending SMAs imply that the yellow metal may be loading for another crack at top levels.

If buyers manage to revive the push up, initial downside pressure could come from the fresh high of 1,588 and resistance overhead of 1,590 from April 2013. Overcoming this, the commodity could stretch for the multi-year obstacle of 1,611.28 ahead of another barrier at 1,619.87 reaching back to February 2013.

Alternatively, if sellers steer below the 23.6% Fibo of 1,575, the Ichimoku lines and support of 1,568 could prevent the price from testing the uptrend line drawn from 20 December last year. Beneath, another significant area around 1,558 — where the Ichimoku upper band and 50- and 100-period SMAs are currently located — could halt the pullback. Diving underneath the 38.2% Fibo of 1,553, sellers may rest at the swing low of 1,546 before the 50.0% Fibo of 1,535 draws traders’ focus.

Overall, the precious metal appears to sustain a short-term positive nature above the trendline.