Fresh Trade Announcement

We saw another period of volatility in the markets yesterday as traders reacted to news of a change in US trade policy. Following Trump’s recent announcement of a fresh set of 10% trade tariffs due to be applied to a further $300 billion of Chinese goods, starting September 1st, US Trade Representative issued a statement yesterday saying that some goods will now have the tariff delayed. The US Trade Representative’s statement explained that the US is delaying imposing tariffs on some imports from China until the 15th of December because of “health, safety, national security and other factors”. The products to have the delay applied to them include mobile phones, laptops, video game consoles, some toys, computer monitors, and certain footwear and clothing.

Tit For Tat Aggression

The news is an important development given the way the trade situation has deteriorated over recent weeks. Following the initial news of fresh tariffs, China responded by sharply devaluing the Yuan which sent USDCNH over 7 or the first time since the global financial crisis in 2008. In response to this, the US Treasury Dept issues a statement in which it labelled China a currency manipulator. In response to the label being applied, for the first time since 1994, China issued a counter statement denying the claims. The market had been fearful that this latest outbreak of tit-for-tat aggression would lead to trade talks being abandoned once again ahead of the next scheduled talks in September.

US /China Talks

The statement from the US Trade Representative Robert Lighthizer comes as China’s Xinhua news agency reported a telephone conversation between him and Chinese vice-premier Liu. The Chinese VP is said to have made a “solemn presentation” against the proposed US trade tariffs. With the US having tempered its initial plans, the market is now hopeful that trade talks will continue and the two sides will once again re-commit to working together to deliver a trade deal.

Market Impact

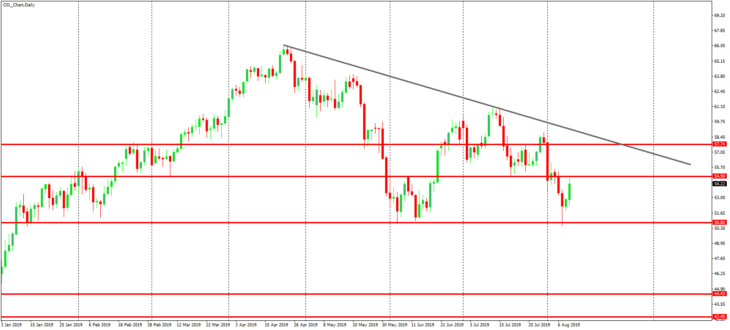

The market impact reflects a great deal of both surprise and relief with safe-haven flows immediately retreating as equities rebounded firmly higher, taking gold prices lower and fuelling a subsequent recovery in oil. However, trepidation remains given the volatile nature of the relationship between the two leading economies and the unpredictable way in which these different announcements keeping popping up. Trump initially announced the new trade tariffs via twitter on the back of the first set of trade talks since negotiations broke down in May. Considering this, traders are very cautious about the potential for a fresh deterioration in the situation if Trump isn’t satisfied with the way things develop. For now, the market waits for the next set of trade talks due to be held in September.

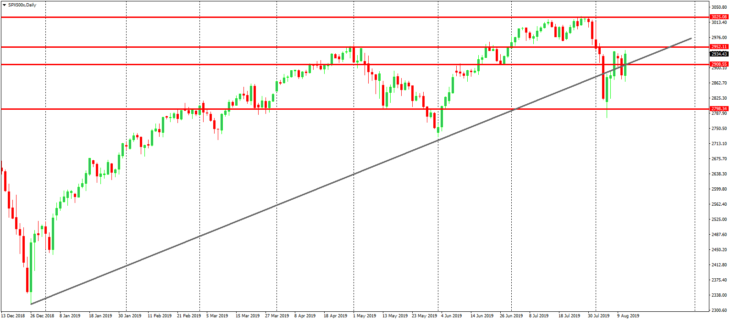

Technical Perspective

The S&P reversed from mid week lows to trade back above both the 2908.55 level and the broken bullish trend line. While above here, focus is on a break of the 2952.11 level which will open up the way for another run back up to the current 3025.08 all time highs. If we fail from current levels however, focus will once again shift back onto a further downside test of the 2798.34 level which was tested last week.

You can see that price recently tested and indeed pierced above the 1522.75 resistance level. This is a major long-term level in gold, having been the 2012 and mid 2011 lows. The level has not been retested since in broke in 2013 and as you can see the first test has given a violent reaction lower. Given the extent of the recent rally in gold some retracement could be likely. However, while above the 1452.05 level, focus remains on further upside.