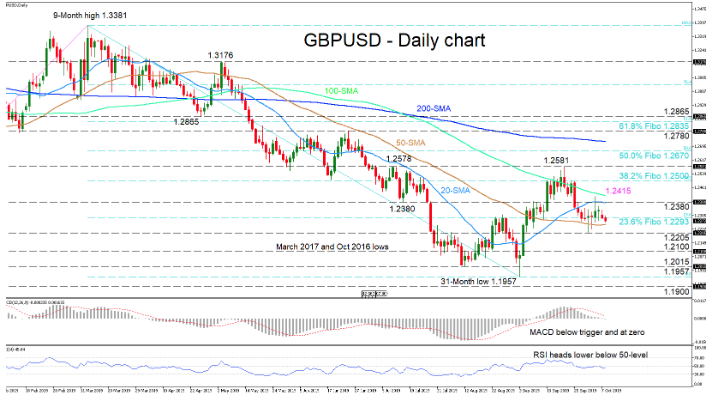

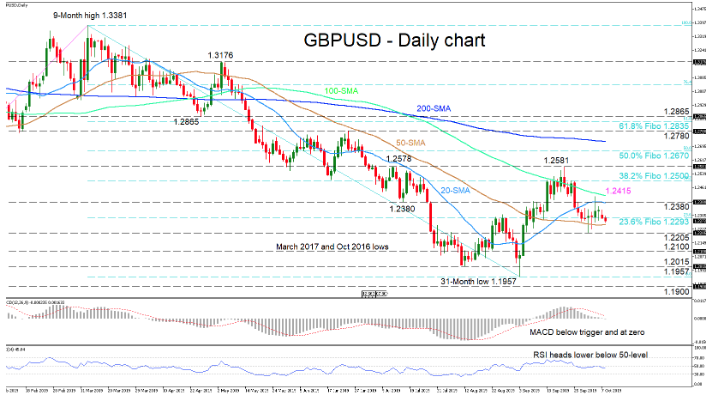

GBPUSD has consolidated around 1.2293, which is the 23.6% Fibonacci retracement of the down leg from 1.3381 to 1.1957, as directional momentum has dried up. The pair is trading within a short-term range of 1.2205 – 1.2415, with the price also being squeezed between the 20- and 50-day simple moving averages (SMAs).

The short-term oscillators lean towards the negative picture as the MACD, which is currently in the positive area, has moved beneath its red trigger line and towards the zero line. Additionally, the RSI remains in bearish territory, with a retreat off the 50-level and now heads lower.

If the bears manage to push below the 50-day SMA and nearby trough of 1.2205, this could revive the negative bias dropping the pair to the 1.2100 handle, which is the low from March 2017 and October 2016. Surpassing this, the price may test the support of 1.2015 coming from August 12. If selling orders continue, the multi-year low of 1.1957 could apply some pressure ahead of the 1.1900 obstacle.

To the upside, moving above the 1.2293 level, the 1.2380 resistance coupled with the 20-day SMA and the nearby 100-day SMA — presently at 1.2415 — could apply significant downside pressure. Overcoming this could have the 38.2% Fibo of 1.2500 encounter the bulls ahead of the swing high of 1.2581. If violated, the 50.0% Fibo of 1.2670 and the swing high of 1.2780 draw traders’ focus.

Overall, the short-term bias is neutral and a break below 1.2205 or above 1.2415 would reveal the directional bias.