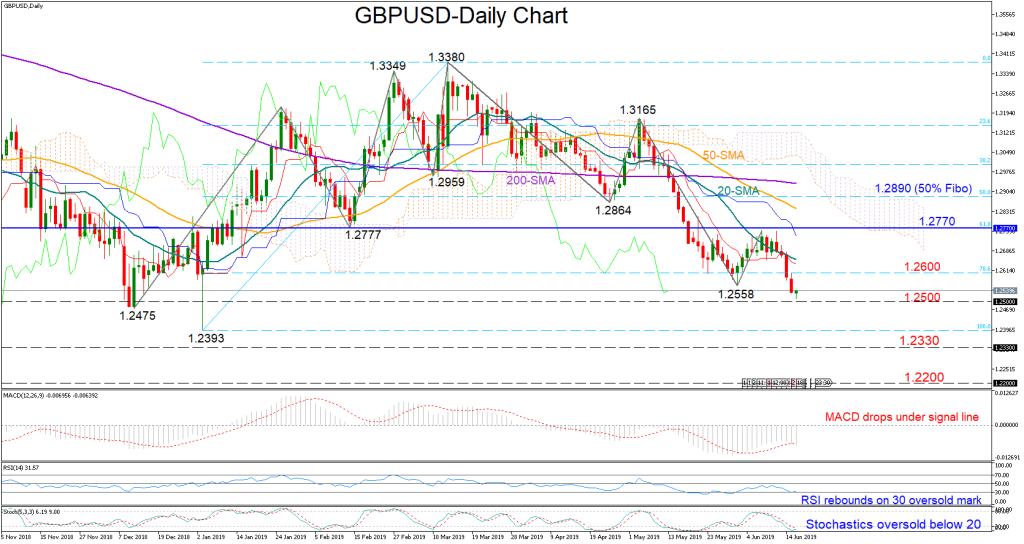

GBPUSD reactivated the downtrend started from the 1.3380 peak to reach a fresh six-month low of 1.2510 on Tuesday. Technically, the pair could lose further momentum as the MACD is crossing below its red signal line. However, with the RSI rebounding on its 30 oversold mark and the Stochastics set for a bullish cross under 20, upside corrections cannot be ruled out in the very short-term.

The area between 1.25 and 1.2475 could be closely watched if the market extends on the downside. Breaking that barrier, all attention will shift to 1.2393, the lowest price recorded since April 2017, while another step lower could test the 1.2330 number, a former restrictive level. Should bearish pressure continue, increasing speculation over a more persisting downtrend, support could run towards the 1.2200 psychological mark.

On the flip side, a closing price above 1.2600 and more importantly higher than the 20-day simple moving average (SMA) currently at 1.2654, could bring some confidence to the market, with traders eyeing 1.2770 next, the 61.8% Fibonacci of the 1.2393-1.3380 upleg. Moving further up, the 50% Fibonacci of 1.2890 could next come into focus.

In the medium-term timeframe, the bearish outlook deteriorated following the drop under the previous trough of 1.2558. A rally above 1.2890 would put the market back to neutrality, though with the 50-day SMA weakening under the 200-day SMA, such a case may came later than sooner.

In brief, GBPUSD is facing a negative risk both in the short and the medium-term.