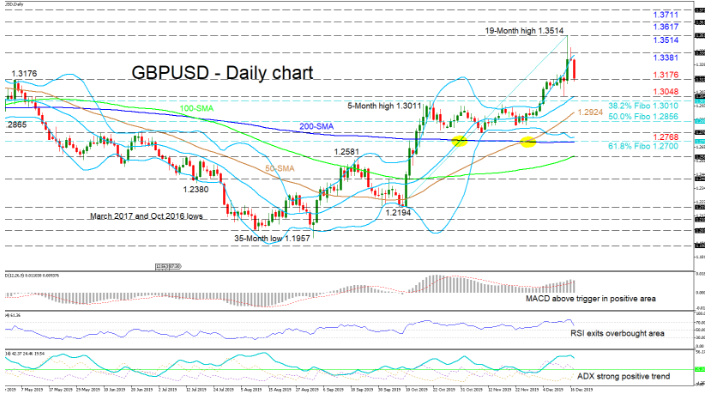

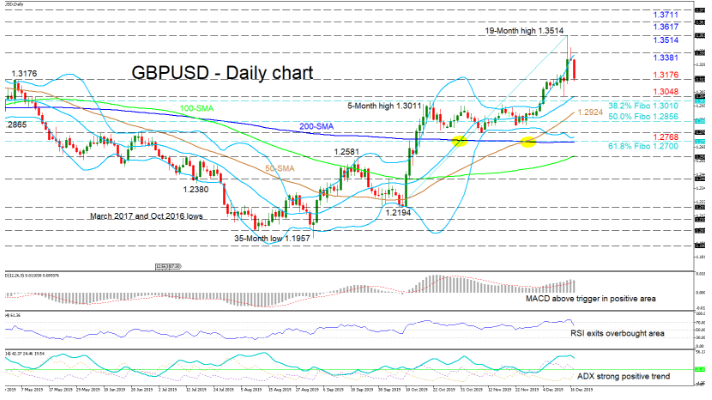

GBPUSD’s positive momentum has eased somewhat, something also backed by the declining RSI, which has exited the overbought area resulting in a pullback off the recent nineteen-month high of 1.3514. However, the positive outlook remains intact assisted by the upward slopes in the mid-Bollinger band, 50- and 100-day simple moving averages (SMAs).

The technical indicators reflect the stall in the ascent, but overall still lean towards an improving picture. The MACD, although decreasing slightly has remained above its red trigger line, deep in the positive region. The RSI is falling in bullish territory while the ADX displays a strong positive trend in place.

If buyers resurface, initial downside pressure could come from the March high of 1.3381. Overtaking this, buyers’ efforts could be tested with a revisit of the fresh peak of 1.3514. Climbing above this too, the 1.3617 high from May 2018 could halt further advances towards 1.3711, which is the inside swing low from March 2018.

Alternatively, if sellers manage to slip below the 1.3176 barrier, next to interrupt the decline is the swing low of 1.3048 — located at the mid-Bollinger band. Beneath, the 1.3010 level would attract attention, which is the 38.2% Fibonacci retracement of the up leg from 1.2194 to 1.3514. Surpassing this, the 50-day SMA at 1.2924 and below the 50.0% Fibo of 1.2856 may challenge the drop towards the tough support region of 1.2768 to 1.2700, consisting of the trough low, the lower-Bollinger band and 200-day SMA residing at the 61.8% Fibo.

Overall, the short-term bias is bullish above the 1.3048 level. Yet, a shift below 1.2768 could return a bearish outlook.