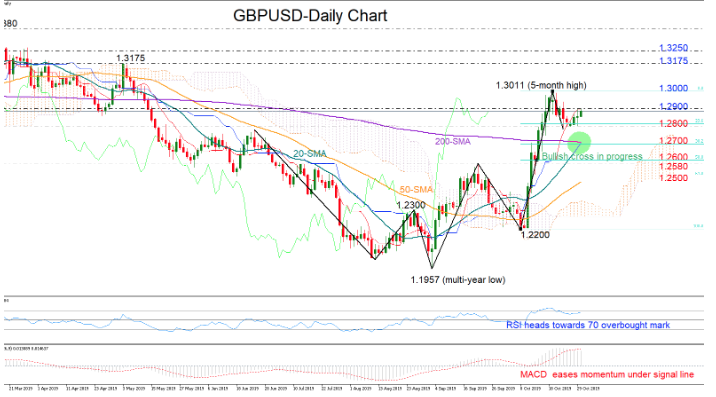

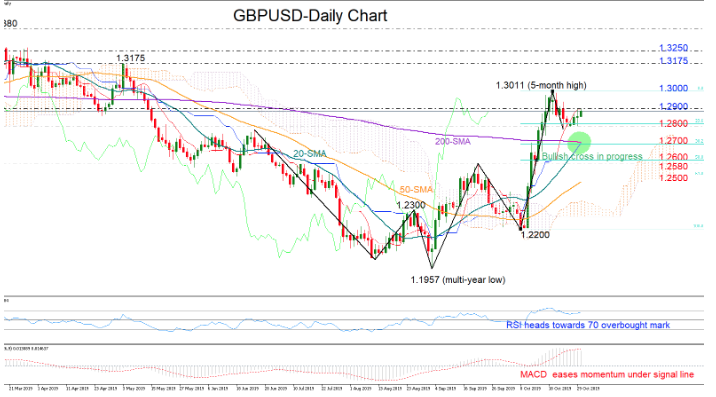

GBPUSD erased a small part of its gains that drove the price near the 1.3000 key resistance area but the 1.2800 mark, which is currently viewed as a nearby support, curbed the downside correction.

The short-term bias is currently looking positive-to-neutral as the RSI is reversing back towards its 70 overbought mark and the MACD keeps losing momentum below its signal line. On the other hand, trend signals seem to be turning even positive as the 20-day simple moving average (SMA) prepares to cross the longer-term 200-day SMA after breaching the 50-day SMA in September (double bullish cross).

A closing price above the 1.2900 level would bring the 1.3000 resistance area back into view. Should the latter prove easy to get through, the rally could stretch up to the 1.3175 level where the market action paused several times in the first half of 2019. Moving higher and above 1.3250, the spotlight will shift to the March peak of 1.3380.

In the negative scenario, a break below 1.2800 and the 23.6% Fibonacci of the upleg from 1.2200 to 1.3011 could stall near 1.2700, where the 20- , the 200-day SMA and the 38.2% Fibonacci all intersect. In case selling interest persists, a more important barrier could appear within the 1.2600-1.2580 area that encapsulates the 50% Fibonacci too, while slightly lower the 1.2500 handle could next take control.

Meanwhile in the three-month picture, the pair is expected to hold an upward direction unless the price corrects below 1.2580.

Summarizing, GBPUSD is likely to follow a positive-to-neutral path in the short-term, while in the medium-term, the outlook may stay positive as long as the price holds above 1.2580.