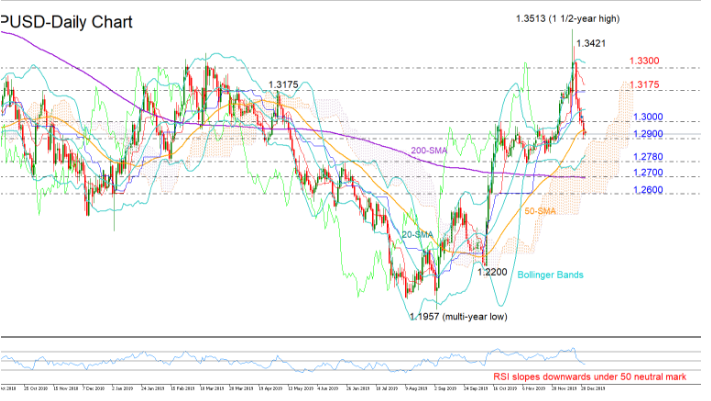

GBPUSD plummeted back to the 1.2900 territory and below its 20- and 50-day simple moving averages (SMAs), erasing all the election gains that drove the pair to a 1 ½ -year high of 1.3513.

The short-term outlook keeps looking cloudy as the price has crossed below the middle Bollinger band but has yet to touch the lower band, while the RSI is also making its way down below its 50 neutral mark.

Should the sell-off strengthen beneath the 1.2900 level that acted as support on Monday, the door would open for the lower Bollinger band which currently hovers near the 1.2780 area. Slightly lower, the 200-day SMA which is flattening around the 1.2700 mark may next come in focus. If it fails to hold, then attention will shift to 1.2600.

On the upside, the market should improve back above 1.3000 to bring some buyers back into the game. In this case, resistance could run up to 1.3175, where any break higher could see a retest of the 1.3300 level.

Meanwhile in the medium-term picture, the pair maintains a bullish profile reflected by the higher highs and higher lows from the 1.1957 trough despite the recent sharp downfall. A decline under 1.2780 would prove that the uptrend is fragile.

In brief, the bearish mood in GBPUSD may stay in place in the short-term, while in the medium-term bullish sentiment could deteriorate if the market weakens below 1.2780.