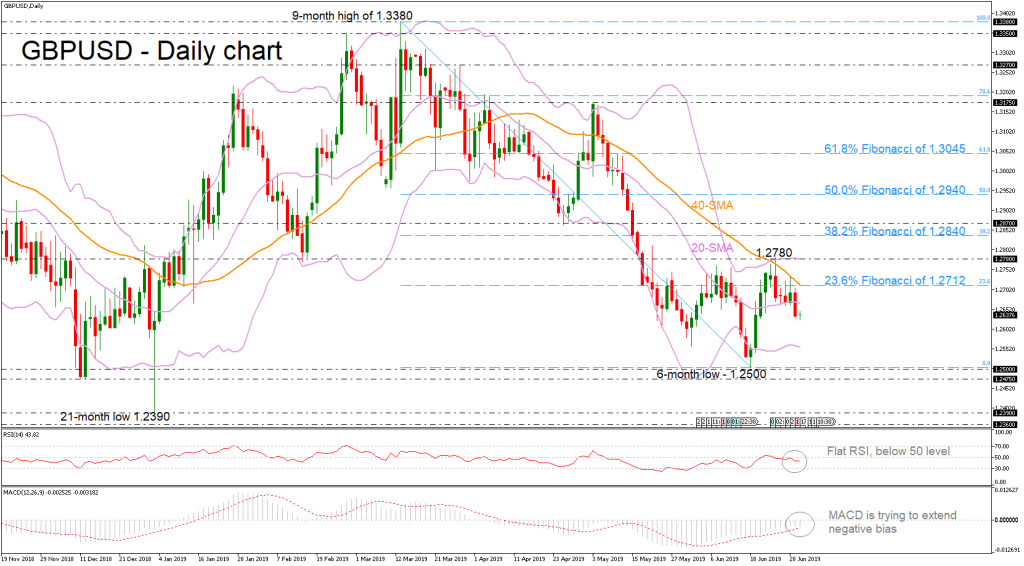

GBPUSD touched the upper Bollinger band around the 1.2780 resistance level in the previous week, driving the market lower, below the 40-day simple moving average (SMA) and the 23.6% Fibonacci retracement level of the downfall from 1.3380 to 1.2500 near 1.2712.

The pair continues the selling interest in the medium-term as it is confirmed by the technical indicators, which have been holding in the negative territory. The RSI is flattening below the 50 level and the MACD is trying to strengthen its negative bias below the zero line.

In case of more losses, the next support level is coming from the lower Bollinger band, currently at 1.2555 before flirting with the six-month low of 1.2500.

Alternatively, if the price shifts to the upside and surpasses the 40-SMA, it could find immediate resistance at the significant area of 1.2780. More bullish momentum could send cable until the 38.2% Fibonacci of 1.2840.

Overall, GBPUSD looks to be bearish in the short- and medium-term picture. Currently, the pair has been developing within the squeezed Bollinger bands, and a close beneath 1.2500 could open the way for more negative actions in the bigger view.