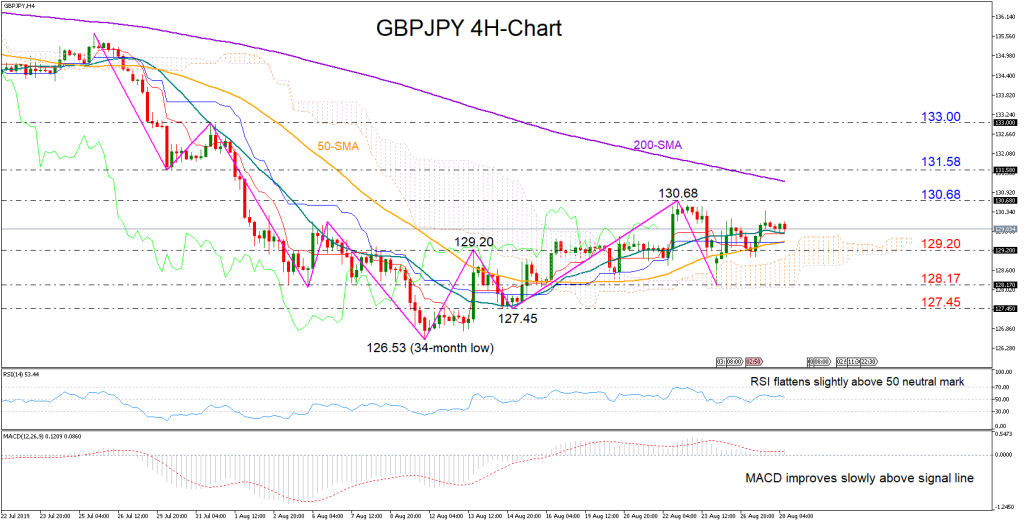

GBPJPY sat on the sidelines after confirming the start of an uptrend by creating a higher low at 127.45 and a higher high at 130.68 in the four-hour chart.

The pair is likely to stay uneventful in the short-term as the RSI and the Ichimoku indicators are flattening and the MACD is rising slowly. However, the fact that the technical measures remain in bullish territory and the 20-period simple moving average (SMA) above the 50-period SMA suggests that the positive bias, even though weak, has not totally faded.

A closing price above 130.68 could extend the uptrend towards the 200-period SMA which the market was unable to pierce since early-May. Slightly higher, the former 131.58 barrier could also prove challenging before the focus shifts to the 133.00 area.

Alternatively, should the pair slip under the 129.20 congested zone, the August 26 low of 128.17 would be the next target as any violation at this point would put the upward pattern in doubt, probably adding more legs to the bearish correction. If that is the case, the price could fall even lower to meet the 127.45 hurdle.

Summarizing, GBPJPY is expected to extend the sideways path in the short-term, though it is also worth noting that some weak bullish signals remain.