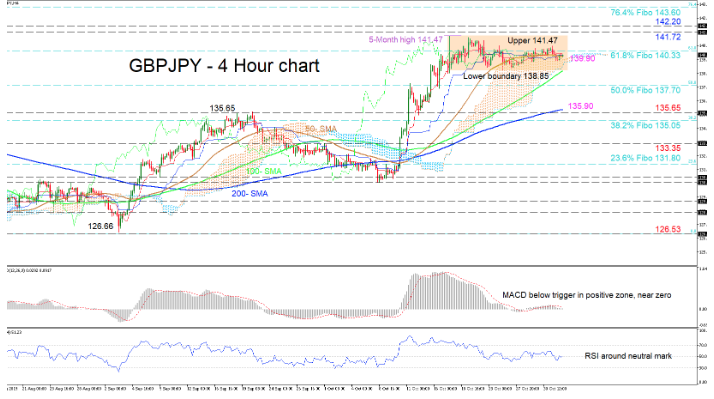

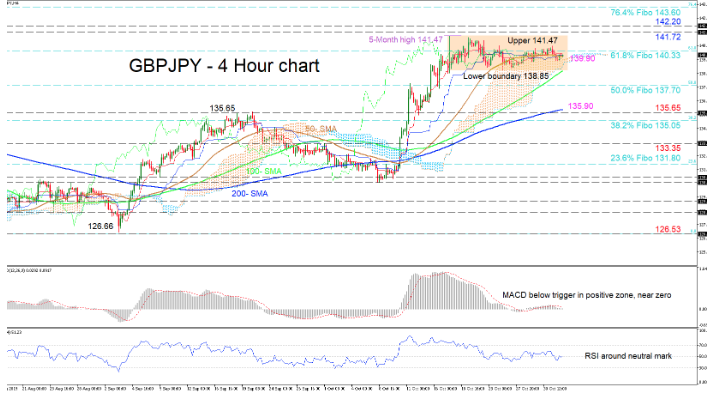

GBPJPY’s directional momentum has disappeared after sellers ceased further gains on October 17, having rallied strongly from October 8. A second attempt higher was denied, shifting the pair into a directionless market, which is also backed by the flat 50-period simple moving average (SMA), Tenkan-sen and Kijun-sen lines.

The MACD, is barely above the zero line but below its red trigger line, while the RSI is reflecting a marginal increase in positive momentum, as it is pointing up at its 50-neutral mark. Despite this, the upward slopes in the 100- and 200-period SMAs support the existing positive picture.

With a current base from the 50-day SMA and the upper band of the Ichimoku cloud, the bulls face a nearby resistance within this range at 140.33, which is the 61.8% Fibonacci retracement of the down leg from 148.86 to 126.53. Next, a more lasting move would be needed, to overcome the downside pressure from the upper boundary of 141.47 (five-month high) and the neighboring resistances of 141.72 and 142.20, to drive efforts to challenge the 76.4% Fibo of 143.60.

Alternatively, if sellers retake the reins and pierce through the cloud, the lower boundary of 138.85 and the 100-period SMA beneath, could be a tougher obstacle to clear ahead of the 50.0% Fibo of 137.70. A further drop could stumble around the 200-period SMA at 135.90 and the support of 135.65 before the 38.2% Fibo is tested.

In brief, the short-term sentiment is neutral-to-bullish above the cloud and a break above 141.47 or below 138.85, would expose the next direction.