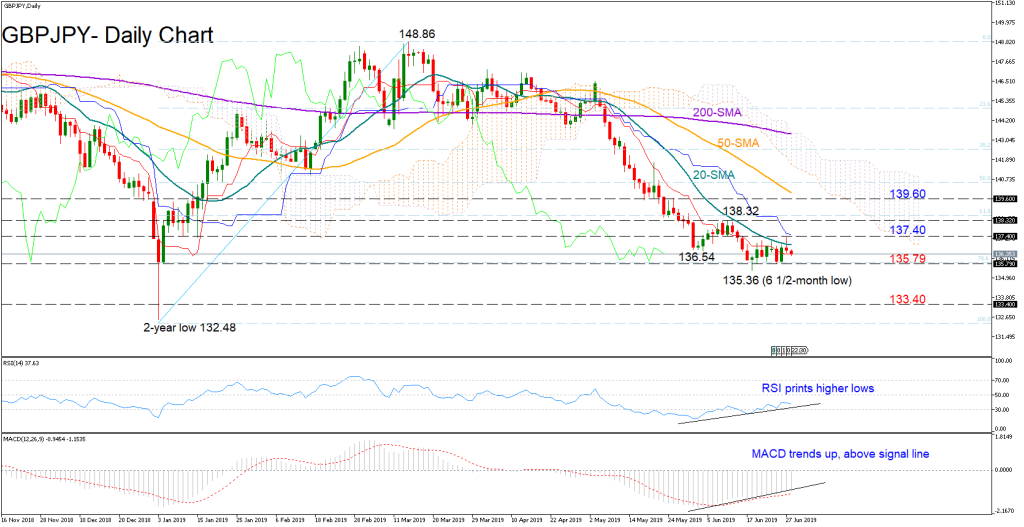

GBPJPY had an uneventful trading for another week, remaining stuck between the 137.40 resistance and the 135.79 key support, which coincides with the 78.6% Fibonacci of the upleg from 132.48 to 148.86 . There is however a bullish divergence signal of a possible trend reversal , as the RSI and the MACD continue to print higher lows at a time when the price keeps trending downwards, suggesting that the market may soon change direction.

A strong rally above the previous high of 138.32 and more importantly above the 139.60 barrier could be interpreted as a validation of the bullish divergence warning. Before that, the price should first breach the 137.40 level.

Alternatively, a break below the 135.79 handle and a decisive close under the 6 ½-month low of 135.36 could strengthen negative momentum, pushing support towards 133.40 and the 2-year low of 132.48 reached in January. Consequently, the medium-term outlook would shift even bearish.

In brief, GBPJPY is trading neutral for the second week but the conflicting signs between the price and the momentum indicators are pointing to a reversal in the bearish trend. Meanwhile, the medium-term picture is holding negative.