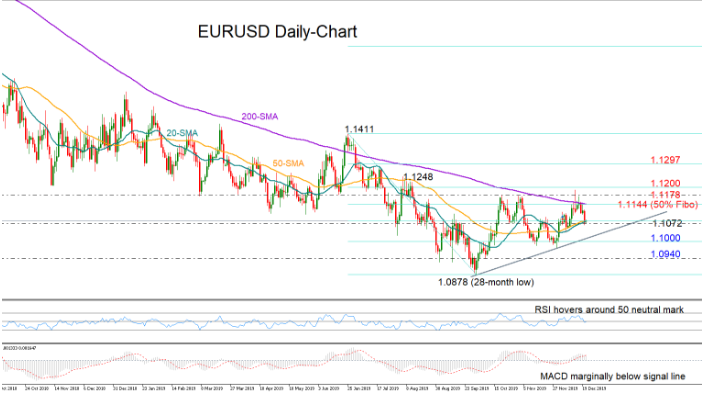

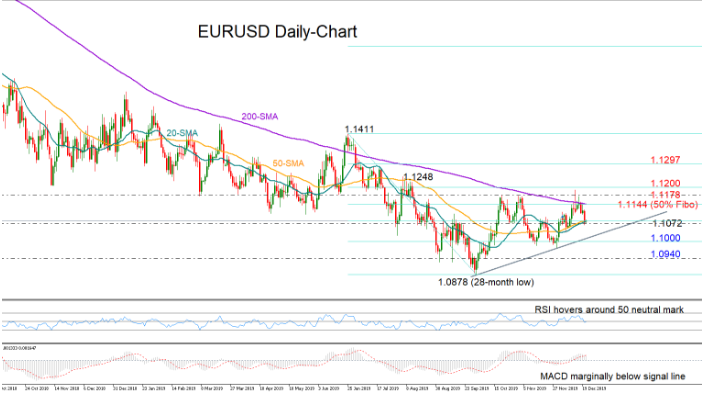

EURUSD could not reactivate it’s two-month old upside direction that stuck around the 1.1178 area as the 200-day simple moving average (SMA) proved hard to overcome last week. Even though the price spiked above the line, registering a fresh high at 1.1198, the bears retook control, driving the market back into the 1.100 territory.

Currently, the pair is pushing efforts to rebound near the 1.1072 key barrier and its 20- and 50-day SMAs but the RSI and the MACD have yet to show a clear upside reversal, with the former holding around its 50 neutral mark and the MACD hovering marginally below its signal line.

Traders will be eagerly waiting for a rally above the 200-day SMA, which currently lies around 1.1140 and near the 50% Fibonacci retracement of the 1.1411-10878 bearish wave. A decisive close above the recent peaks plotted at 1.1178 and more importantly higher than the 61.8% Fibonacci of 1.1200 could add more sparkle to the bullish force, pushing resistance probably up to 78.6% Fibonacci of 1.1297.

Alternatively, failure to hold above 1.1072 would shift the spotlight to the tentative ascending trendline stretched from the 28-month low of 1.0878. Should the bears breach the 23.6% Fibonacci of 1.1000 too, then support could run down to 1.0940.

Looking at the three-month picture, the neutral outlook remains intact as long as the price keeps trading below 1.1178.

In brief, the short-term bias for the EURUSD market looks neutral-to-bearish. A decisive close above 1.1178 could raise buying interest both in the short- and medium-term timeframe.