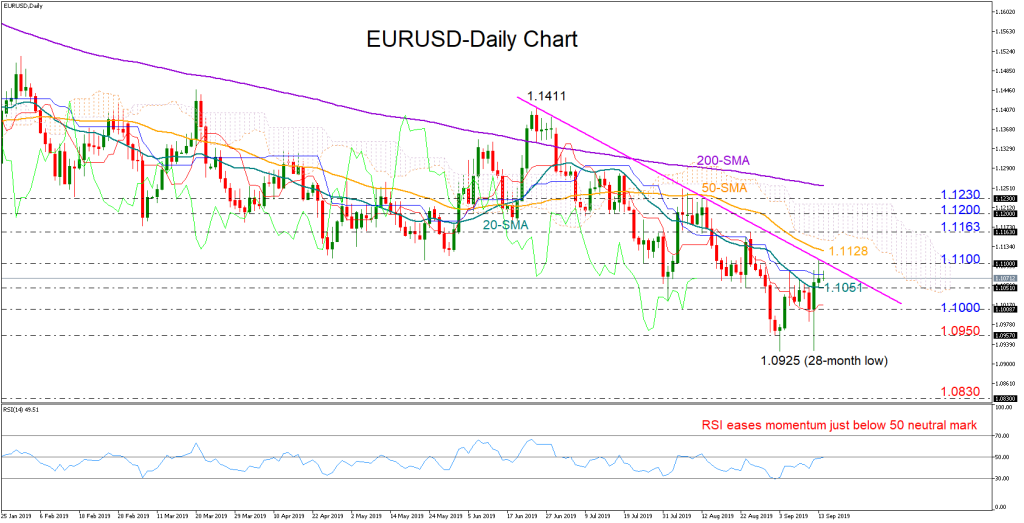

EURUSD managed to quickly recover from 28-month lows last week but once again the bulls did not have the strength to close above the down-trending line drawn from the 1.1411 peak.

The short-term bias is now looking neutral-to-bearish as the RSI eases momentum marginally below its 50 neutral mark and the red Tenkan-sen is stabilizing well under the blue Kijun-sen line.

For a meaningful rally, buyers need to snap the descending trend-line seen around 1.1100 and particularly close above the 50-day simple moving average (SMA) currently near 1.1128. An extension above the previous high of 1.1163 could cement the latest rebound and stretch it towards the 1.1200-1.1230 resistance zone.

On the other hand, another rejection from the descending line and a pullback below the 20-day SMA could initially see a retest of the 1.1000 -1.0950 area and then a review of the 28-month low of 1.0925. Beneath the latter, the sell-off could pause near the 1.0830 former support level before a stronger barrier potentially appears around 1.0700.

In the medium-term picture, the market continues to print lower highs and lower lows, with the falling 50-day SMA reducing the odds for an outlook reversal.

Summarizing, EURUSD is expected to register a neutral-to-bearish print in the short-term unless the price breaks above 1.1128. In the medium-term, the downward pattern is likely to stay in play.