Previous:

The majors all closed down against the US dollar last week. The biggest loser was the New Zealand dollar (-2.60%), followed by the Australian dollar (-1.84%), the pound (-1.13%), the Swiss franc (-1.10%), the euro (-1.10%), the Canadian dollar (-1.07%), and the yen (-0.37%).

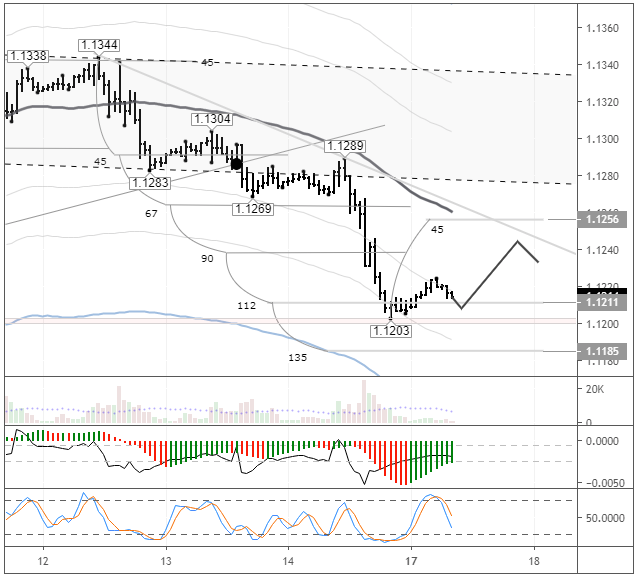

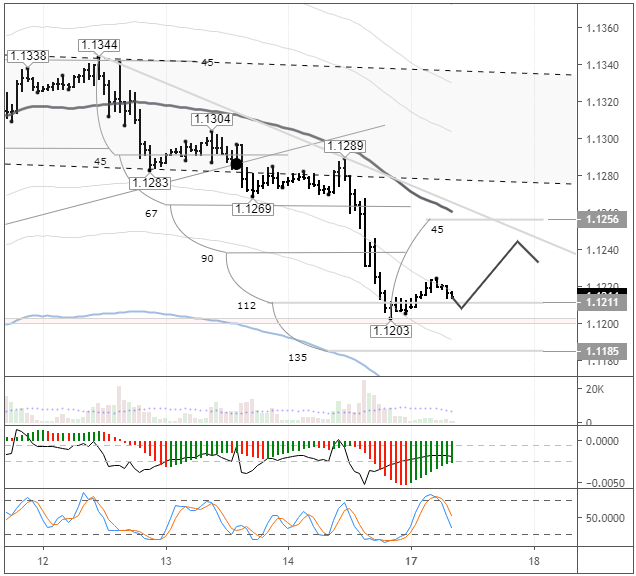

The EURUSD pair dropped from 1.1289 to 1.1203 on Friday. Sales began in the European session after a breakout of the 1.1265 support. The dollar shot up following the release of US data. The retail sales and industrial production indices exceeded expectations, tempering fears of an economic slowdown.

Industrial production rose by 0.4% MoM against a forecasted rise of 0.2% and a previous reading of -0.4% (revised from -0.5%).

Day’s news (GMT+3):

- 13:00 Germany: German Buba monthly report.

- 15:30 Canada: foreign portfolio investment in Canadian securities (Apr), Canadian portfolio investment in foreign securities (Apr).

- 15:30 US: NY Empire State manufacturing index (Jun).

- 17:00 US: NAHB housing market index (Jun).

- 20:00 Eurozone: ECB’s President Draghi speech.

- 21:30 Canada: BoC’s Schembri speech.

- 23:00 USL net long-term TIC flows (Apr).

Current situation:

The dollar was expected to remain weakened ahead of the Fed meeting, although positive data showed that it’s too early to count the US economy out. US10Y bond yields surged in response, while the major pairs continued downwards.

Today is Monday. Since trading on Friday closed with a steep drop, today I’m looking for movements against Friday’s. The pair is trading between the 112th and 135th degrees, which gives us more reason to believe that we will get a correction. There’s a support at 1.1200. I expect to see the pair recover to 1.1245 by 21:00 EET. The balance line should be at this level by this time.

Could we drop further? Yes, we could. The 135th degree is at 1.185. We could easily drop as far as this to give us a bullish divergence on AO and CCI indicators. Pay no attention to the stochastic going against the trend; we still need additional confirmation.