On Thursday, January 9, the euro was up one point at the close of trading. The price consolidated at 1.1105, in a narrow range. It was business as usual after President Trump’s speech on Wednesday, as the markets braced themselves ahead of the publication of the US Non-Farm Payrolls report, scheduled for later on today.

Today’s events (GMT+3)

- 09:45 Switzerland: Unemployment Rate s.a (MoM) (Dec).

- 10:45 France: Industrial Output (MoM) (Nov).

- 16:30 Canada: Net Change in Employment (Dec).

- 16:30 USA: Nonfarm Payrolls (Dec), Average Hourly Earnings (YoY) (Dec), Labor Force Participation Rate (Dec).

- 21:00 USA: Baker Hughes US Oil Rig Count.

Current situation

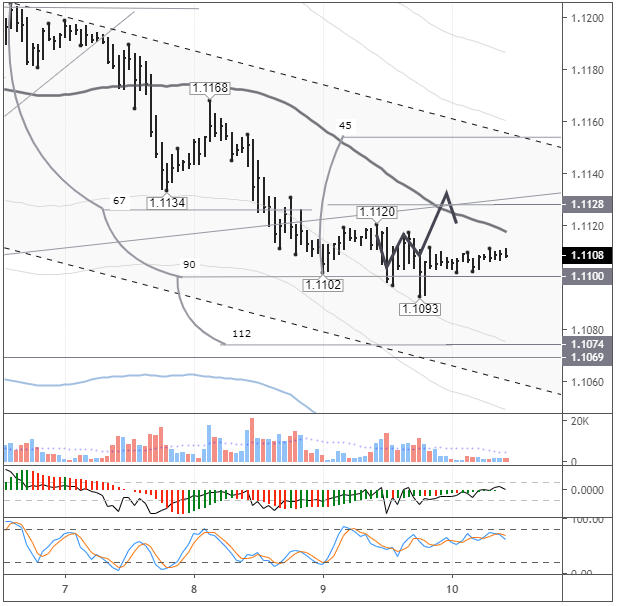

The price did not recover to 1.1130, as predicted. In fact, it was in a horizontal range of 1.1100-1.1120. In six hours, we can expect the price will meet with the balance line. When this happens, the market will be ripe for sharp fluctuations to occur.

Today, the focus is on the US Non-Farm Payrolls report. It is predicted that employment increased by 164,000 in December, compared with an increase of 266,000 in November, while the unemployment rate stayed around 3.5%. The indicator for jobs is unpredictable, therefore, has a strong influence on the main pairs. On days like this, it is better to refrain from making forecasts. Although technically, the pair is ready to decline.

Trump tweeted that he would sign the trade agreement with China on January 15, the ceremony will take place at the White House with senior Chinese figures in attendance. Chinese Deputy Prime Minister Liu He, who leads the country’s negotiating delegation with the US, will be in Washington on January 13-15.