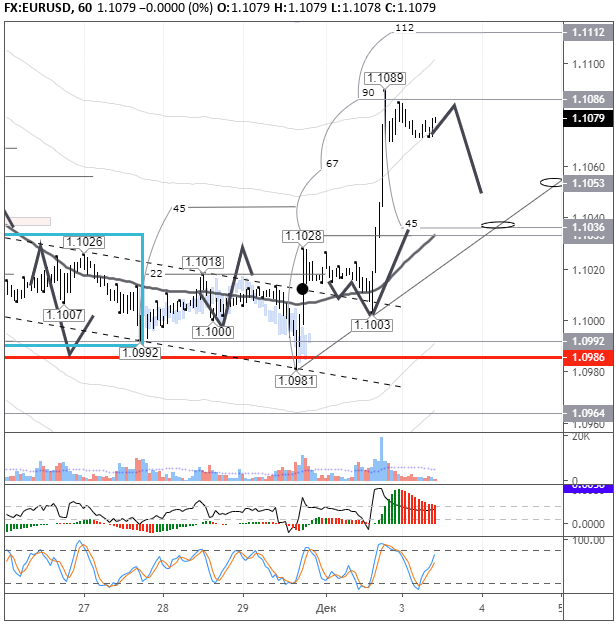

On Monday the 2nd of December, the euro was up at the end of the day’s trading. Before the opening of the American session, the euro fell to 1.1003. The pullback amounted to 50% of the growth from 1.0981 to 1.1028. Active purchases began from 1.10 before ECB President Christine Lagarde’s speech. During her performance and due to the release of weak economic results published by the United States, the currency pair quickly grew to to 1.1089.

The ISM index of business activity in the US in November was below the projected level, as well as the index of construction expenses in October. The publication of these statistics had a negative impact on the dollar and stock exchanges.

Day’s news

- 10:30 Switzerland: Consumer Price Index (MoM) (Nov).

- 12:30 UK: Markit Construction PMI (Nov).

- 13:00 Eurozone: Producer Price Index (MoM) (Oct).

- 20:30 Eurozone: ECB’s Cœuré speech.

Current situation

Yesterday’s expectations were fully justified. The price was corrected and a bullish rally was demonstrated, which stopped at the 90th degree.

The EURUSD pair is consolidating at 1.1073, 23.6% higher than the upward movement from 1.1003 to 1.1089. Buyers will now try to set a new high to create a five-wave structure. The conditions for continued growth are ideal, and the downdrift will be cyclic, lasting until the end of the day. In this regard, according to the forecast, until 16:00 (GMT +3), we can expect to see a recovery, and then a fall to 1.1049. This takes into account the minimum pullback level that fits into the cycles. If the fall takes place at a faster rate than the forecast line, then it is worth taking a closer look at the level of 1.1036, which is located on the trend line. That’s where the 45th degree is located. Growth can reach up to the 90th degree. Bulls have paved the way for 1.1112. It will end when the rate drops below 1.1035.

Bear in mind this week’s key events are the Bank of Canada meeting, the publication of the report into the US labor market, the OPEC meeting, as well as the ongoing tension between the USA and China.

US Commerce Secretary Ross said Trump would raise trade duties on Chinese goods if no agreement is reached with China. It is unlikely that the euro will continue to grow at the same rate as yesterday.