On Friday, January 17, the euro was down at the close of trading. The euro followed in the footsteps on the GBP, which fell heavily against the US dollar after weak retail sales figures for December were published in the UK. The data increased the likelihood that the Bank of England would decide to lower the level of basic interest rates in the country at its next meeting. The EURUSD pair fell to 1.1086. By the end of the day, the euro had fallen 0.43%, and by 0.26% across the entire week.

The American session saw continued pressure on the euro, due to the upcoming long weekend in the US.

Today’s events (GMT+3)

- 14:00 Germany: German Buba Monthly Report.

- 21:30 Eurozone: ECB’s President Lagarde speech.

- National holiday in USA.

Current situation

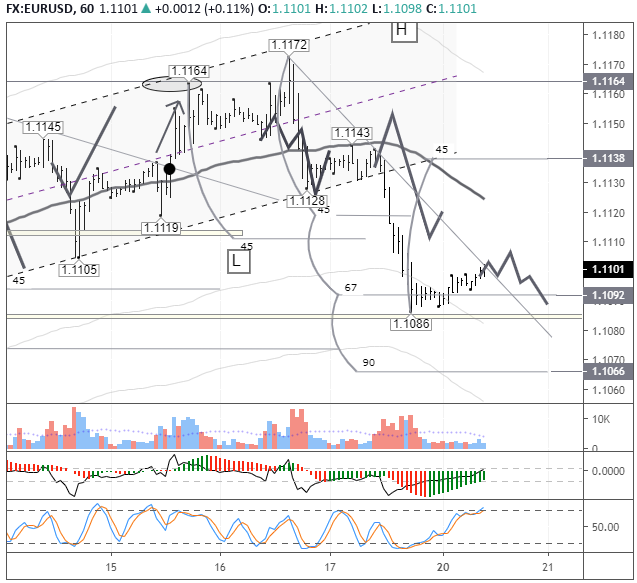

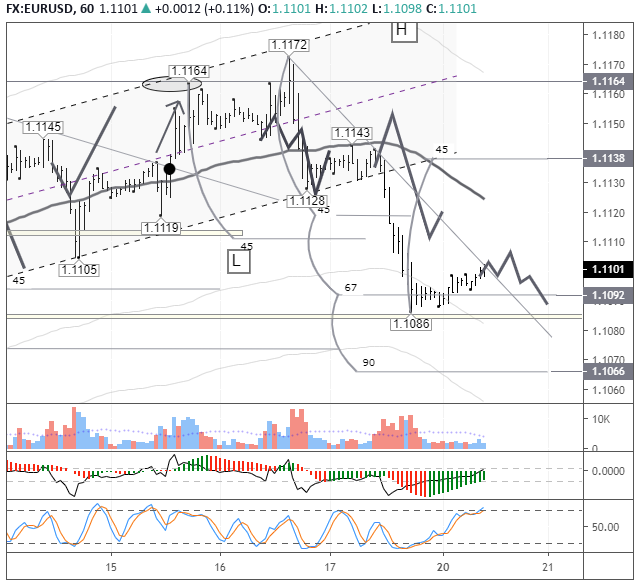

Friday’s expectations for a decrease in the EURUSD pair were fully justified, with the fall In price ended at the 67th degree. On the hourly chart, a three-wave structure has formed from 1.1172. According to the AO indicator, there is no defined end to the downward movement, and bears may attempt to set a new minimum at the 1.1086 mark.

At the time of writing, the euro is worth 1.1099. The price is hovering around the trend line at 1.1172. Given that there is a national holiday in the US, and the Stochastic Operator is in the oversold zone, it is forecast to grow to 1.1106 with a subsequent drop to 1.1089.

Most major currencies are trading in the black, and the economic calendar is scarce. A spike in volatility may be caused by the head of the ECB Christine Lagarde, who is scheduled to speak at 21:30 Moscow time. According to the forecast, we considered a weak rebound, however there could be a sharp “double bottom” — it all depends on the bulls’ activity. Crosses with the euro are all up, with the exception of EURAUD. If Monday’s price stays above 1.1086 until Tuesday, then bulls will have the opportunity to restore the price to 1.1140.