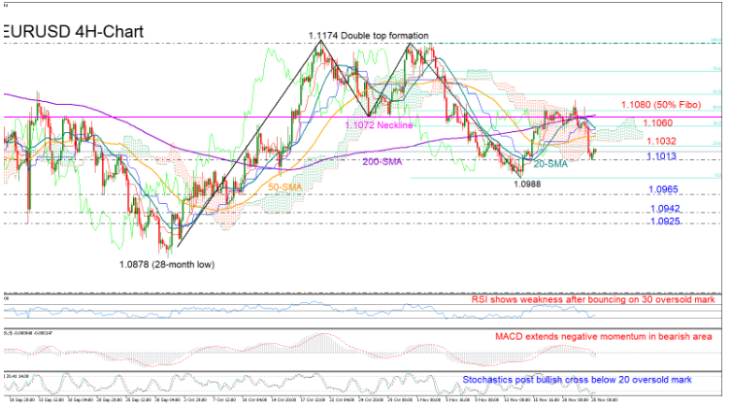

EURUSD reversed sharply lower last week after failing to close decisively above the broken neckline of the double top formation and the 50% Fibonacci of the downleg from 1.1174 to 1.0988, confirming a trend reversal in the four-hour chart.

The trend indicators are also discouraging. The 20-period simple moving average could not rise above the 200-period SMA, and with the price crossing under the Ichimoku cloud, expectations are for the trend to remain on the downside in the short-term.

As regards the price momentum, the fast-Stochastics look ready to exit the oversold area. However, the RSI should increase momentum towards its 50 neutral mark and the MACD should return above its signal line to increase the odds for a meaningful rebound in the price.

Should the sellers drive the price below the previous low of 1.1013, the pair could revisit the 1.0988 trough reached earlier this month. Breaking that bottom, support could next be detected around the 1.0966 barrier and then within the 1.0942-1.0925 area.

On the upside, the bulls would aim for the 1.0720 neckline and the 50% Fibonacci of 1.1080, a significant break of which would eliminate fears of a down-trending market. Yet to reach that area, the bulls should first overcome immediate resistance around the 23.6% Fibonacci of 1.1032 and the 38.2% Fibonacci of 1.1060.

In brief, EURUSD is expected to remain under pressure in the short-term, with traders looking for immediate support around 1.1013.