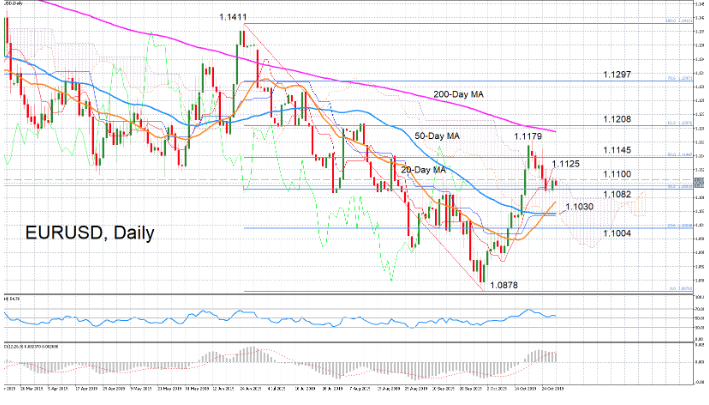

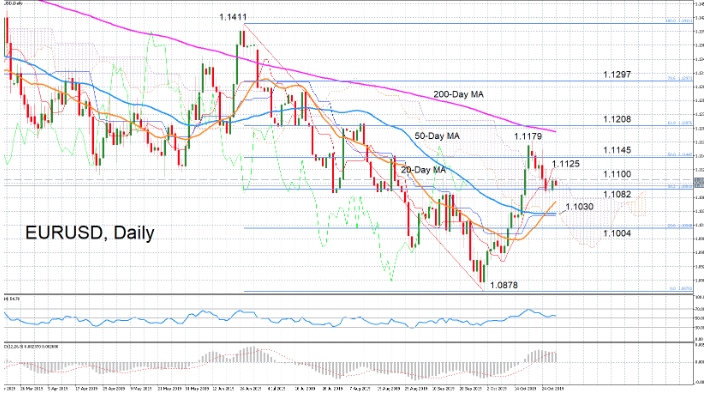

EURUSD has turned neutral in the short term after falling into to the Ichimoku cloud. But despite being restricted by the cloud top, the risks for the pair are to the upside as the RSI is still in positive territory, though it has flatlined, while the MACD remains some distance above zero, having just slipped below its red signal line.

Another positive signal is from the Tenkan-sen line, which continues to rise and increase its distance from the Kijun-sen line. The Tenkan-sen line, currently at 1.1125, is likely to be the next hurdle for EURUSD should it manage to overcome immediate resistance at the top of the cloud at just above the 1.11 handle.

After that, the upward push could stall at the 50% Fibonacci retracement of the downleg from 1.1411 to 1.0878 before attempting to break above the October top of 1.1179, which was a more than 2-month high. Clearing this top would put the pair on a stronger footing to challenge the 61.8% Fibonacci at 1.1208, which it needs to beat if it is to return to a bullish outlook in the medium term.

However, should momentum weaken further, EURUSD is likely to drop below the 38.2% Fibonacci at 1.1082 and head towards key support in the 1.1030 region, which encompasses the 50-day moving average, the cloud bottom and the Kijun-sen line. Failure to hold above this support area would put the pair back in a bearish mode, opening the way for the 2½-year low of 1.0878 and also threatening the neutral picture in the medium term.