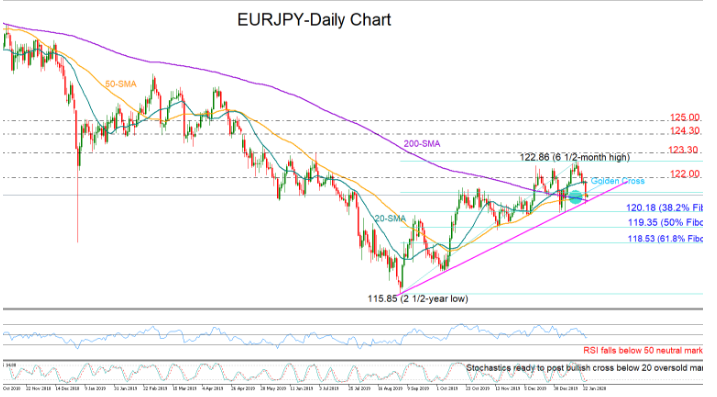

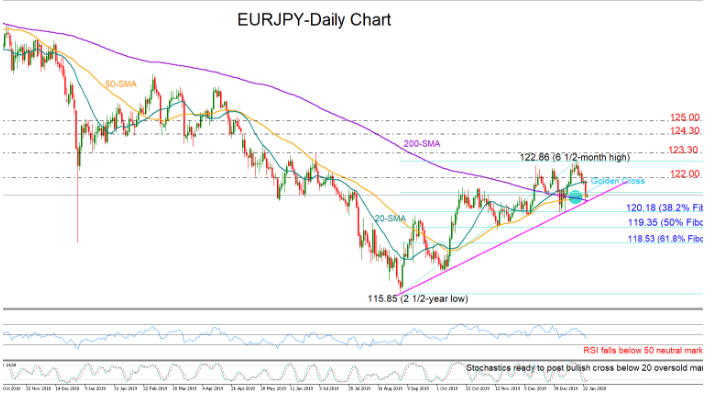

EURJPY could not lift the 122.63 bar last week and reversed south to test the ascending trendline drawn from the 2 ½-year low of 115.85.

The falling RSI which has crossed under its 50 neutral mark suggests that the bearish bias has not faded yet. However, with the Stochastics already located within the oversold area and the price trading near the supportive trendline, an upside correction would not be a surprise.

Should the bears break the trendline, the 120.18 level, which is also the 38.2% Fibonacci of the upleg from 115.85 to 122.63 could come in defense. Retreating lower, the pair would create a lower low, increasing speculation that the uptrend off 115.85 is not sustainable. As such, selling pressure could pick up steam towards the 50% Fibonacci of 119.35, where any violation could open the door for the 61.8% Fibonacci of 118.53.

Nevertheless, if a rebound happens, the 122.00 round-level could attempt to limit the rally ahead of the 122.86 peak and the 123.30 resistance level. Another leg up would turn the medium-term picture more positive and bring the 124.30 -125.00 next into focus.

It is also important noting that the 50-day simple moving average (SMA) has climbed above the 200-day SMA, after more than a year, encouraging over a trend improvement in the medium-term picture.

In brief, the short-term bias remains bearish in the EURJPY market and it would be interesting to see whether the ascending trendline could save the pair from additional downfalls. Meanwhile in the medium-term picture positive trend signals seem to be strengthening following the creation of a golden cross.