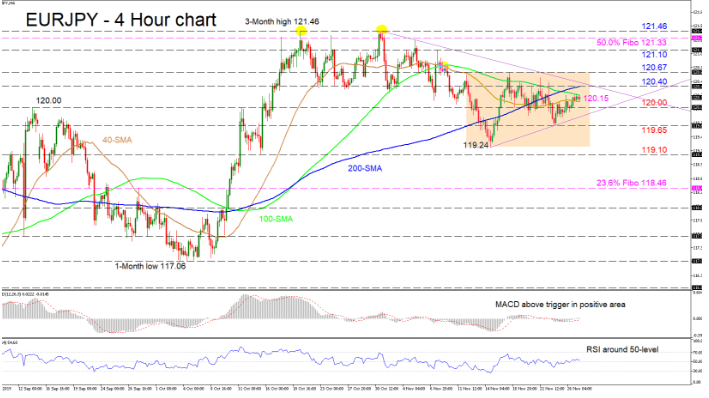

EURJPY looks to be undecided over the last two weeks, following the decline from the high of 121.46. Furthermore, momentum seems to have evaporated, something also backed by the 40- and 100-period simple moving averages (SMAs), which are turning slightly sideways.

The short-term oscillators, although suggest a dry up in directional momentum, are reflecting a marginal improvement in the positive picture. The MACD is above its red trigger line and has just moved above zero into the positive zone, while the RSI is hovering around its neutral mark in the bullish region. Moreover the 200-period SMA is rising despite the recent bearish crossovers.

If buyers drive the price above the 100-period SMA around 120.15, the 120.40 level — coupled with the 200-period SMA — and nearby resisting line could halt the pair gaining ground. Pushing above, the 120.67 swing high from November 18 could challenge the bulls, while successful attempts to climb higher could reach the 121.10 resistance, the 121.33 level, which is the 50.0% Fibonacci retracement of the down leg from 126.80 to 115.85, and the 121.46 peaks of October.

Alternatively, if sellers push below the 40-period SMA, immediate support could come from the 120.00 level, followed by the supportive line and nearby 119.65 swing low. Surpassing this, the 119.24 trough and neighboring 119.10 support could cease further declines towards the 23.6% Fibo of 118.46.

In brief, the short-term bias looks neutral and a break above 120.67 or below 119.10 would set the next direction.