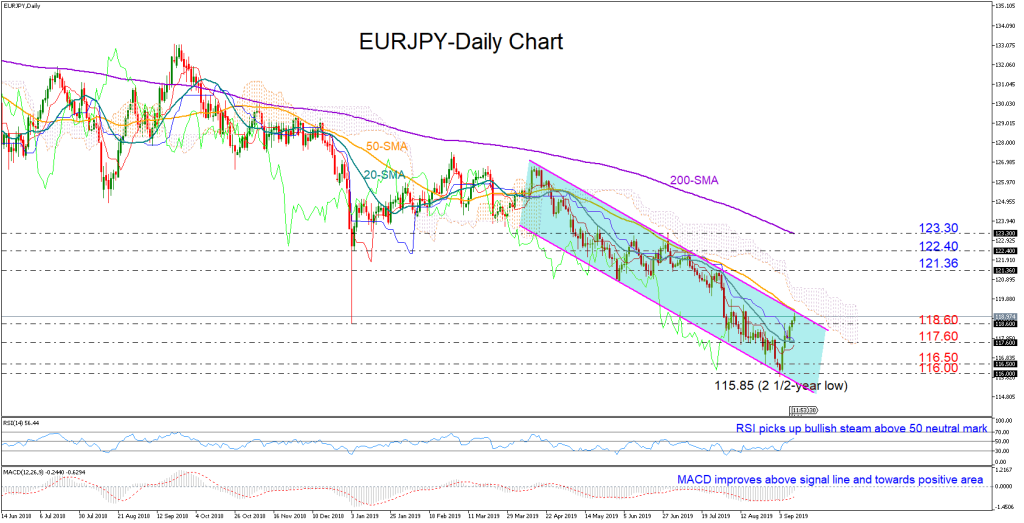

EURJPY is prolonging the rebound off the 2 ½-year low of 115.85 as the RSI and the MACD are signaling mounting buying interest, with the former surpassing its 50 neutral mark and the latter improving above its signal line.

Questions however remain about whether the bullish forces are strong enough to violate the descending channel to the upside.

Should the price close comfortably above the channel, piercing the lower surface of the Ichimoku cloud and resistance around 119.86 as well, the rally could extend towards the 121.36 barrier. Further up, the area between 122.40-123.30, where the 200-day simple moving average (SMA) is heading, could allow for more gains if it gets breached. The latter could also change the structure of the medium-term picture from bearish to neutral, though with the 50-day SMA slipping below the 200-day SMA, an outlook reversal may come later rather than sooner.

Alternatively, if the bulls bounce off the channel bar currently seen around 119.35, the market could immediately retest the 118.60 support-turned-resistance level. Correcting lower, sellers would shift attention towards the 20-day SMA currently around the 117.60 obstacle, a break of which could bring the 116.50-116.00 zone back in the spotlight.

In brief, EURJPY is facing improvement in buying appetite in the short-term, though only a closing price above the channel would confirm the positive sentiment. In the medium-term picture, a stronger upturn above 123.30 is needed to eliminate the bearish risk.