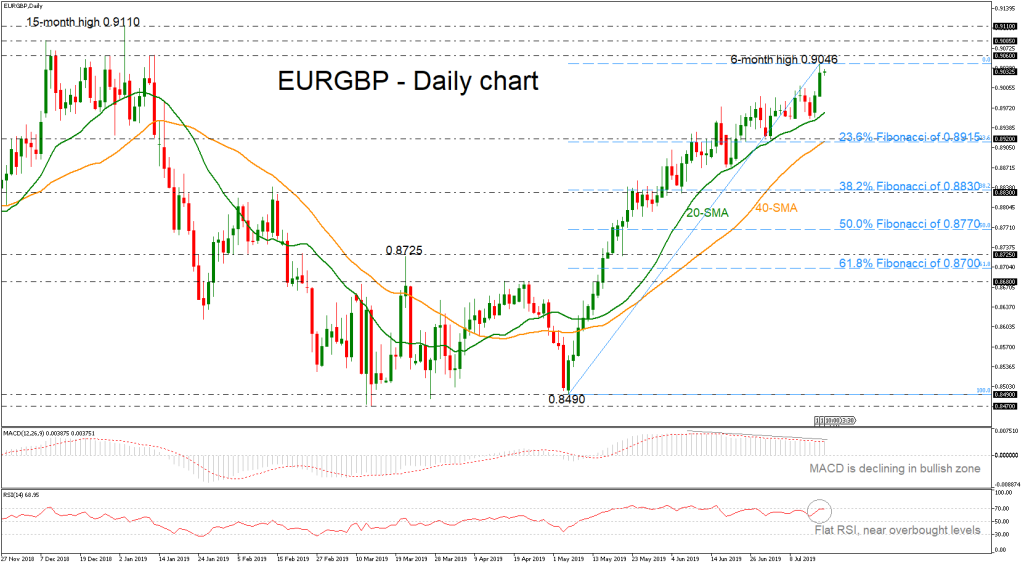

EURGBP skyrocketed in the preceding couple of days, challenging a new six-month high of 0.9046. The rebound on the 0.8490 drove the pair to an upside rally above the 20- and 40-simple moving averages (SMAs) in the daily timeframe, confirming the bullish tendency.

However, looking at the technical indicators, they seem overbought, suggesting a possible downside pullback. The MACD oscillator is weakening a bit slightly below the trigger line in the positive area, while the RSI is flattening after it touched the 70 level.

In case of further advances the price could attempt to overcome the multi-month high and retest the 0.9060 resistance, which if successfully broken the door would open for the 15-month peak of 0.9110 reached on January 3. Should investors continue to buy with strong momentum the pair above that peak, resistance could then run towards the 0.9300 handle.

A reversal to the downside, could find immediate support at the 20-day SMA currently at 0.8965. Even lower, the 0.8920 and the 23.6% Fibonacci retracement level of the upleg from 0.8490 to 0.9046, near 0.8915, which coincides with the 40-SMA, could also come into view. If the latter fails to halt bearish movements, the next target could be the 38.2% Fibo near 0.8830.

To sum up, the market is expected to hold bullish in short-term, but if the technical indicators prove true for a weaker tendency, the price could post a bearish correction move.