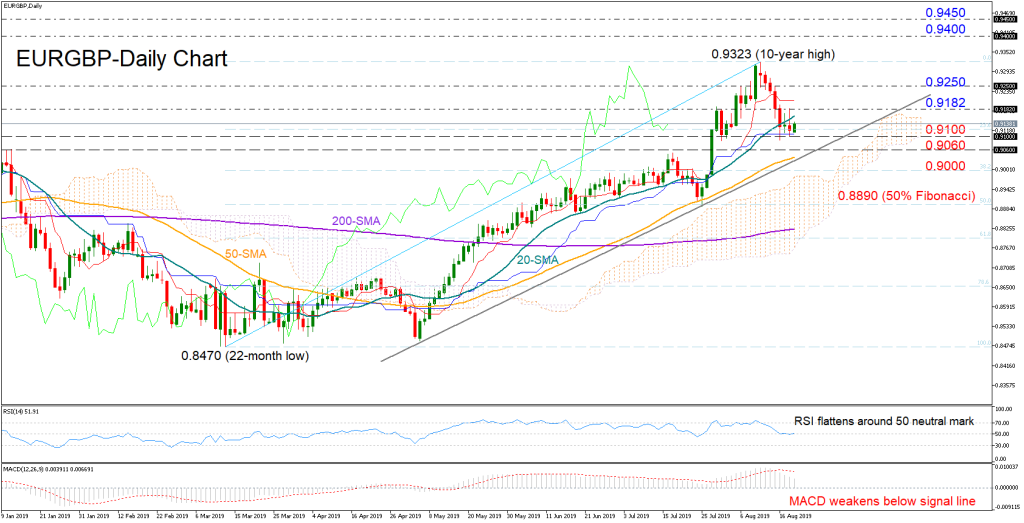

EURGBP registered sharp losses for the first time after 14 weeks following the peak to an almost decade high of 0.9323. The market switched to consolidation this week, moving sideways around the 0.9100 support area, with the flattening RSI and the falling MACD painting an overall neutral-to-bearish picture for the short-term.

Should the downside correction stretch below 0.9100, the area between 0.9060 and the 50-day simple moving average could act as immediate support before the focus turns to the 0.9000 round-level where the 38.2% Fibonacci of the 0.8470-0.9323 upleg is located. Breaking even lower, a more important barrier could be detected near the July 25 low of 0.8890 which also coincides with the 50% Fibonacci extension. Any decisive close below the latter could be a warning of a down-trending market.

In the event of an upside correction, nearby resistance is likely to emerge around 0.9182, while slightly higher, the bulls could retest the 0.9250 level ahead of the 0.9323 peak. Beyond recent highs, the rally may next challenge the 0.9400-0.9450 region which proved a strong wall to stop bullish actions in 2009.

In the medium-term picture, EURGBP is still in the green zone and is likely to maintain the bullish profile as long as it keeps trading above the 50-day simple moving average (SMA) and the upward-sloping trend line.

Summarizing, EURGBP short-term bias is currently viewed neutral-to-bearish, while the outlook in the medium-term remains positive.