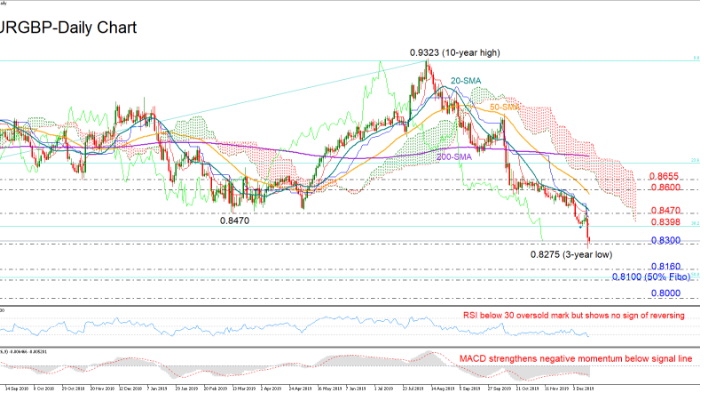

EURGBP stretched its sharp downfall from Friday to retest the base of its three-year old range, as it traded near the 0.8300 round level.

Technically, the market is hovering in oversold waters according to the RSI which expands below its 30 level and therefore the odds for price reversal are rising. However, with the indicator holding a downward slope (also in the four-hour chart), the Ichimoku indicators heading south, and the MACD showing no signs of easing its negative momentum, the short-term bias is practically viewed as bearish.

Beneath the 0.8300 number, the 0.8160-0.8100 area was a reliable restrictive zone during the 2008-2016 period and hence will be closely watched if selling pressure accelerates. This is also where the 50% Fibonacci of the upleg from 0.6935 to 0.9323 is located, adding some extra importance to the region. Breaching that block, the 0.8000 psychological level could come under the spotlight ahead of the 61.8% Fibonacci of 0.7836.

Alternatively, a rebound in the price could prove meaningful only if the bulls manage to crawl above the 0.8470 support-turned-resistance mark and the 20-day simple moving average (SMA), clearing the 38.2% Fibonacci of 0.8398 too on the way up. Should this scenario materialize, attention will shift back to the 0.8600-0.8655 former congested area.

Meanwhile, signals for the medium-term traders are discouraging as well given the ongoing negative pattern off the 10-year high of 0.9323 and the declining 50-day SMA that continues to deviate below the 200-day SMA.

In brief, although EURGBP is near a crucial support area, increasing speculation of an upside reversal, technical indicators continue to paint a bearish picture for the short- and medium-term.