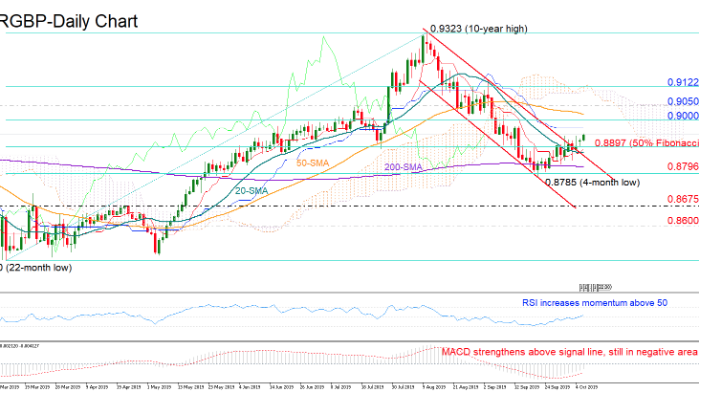

EURGBP crawled above the ascending channel and managed to return above the 50% Fibonacci of the upleg from 0.8470 to 0.9323, providing some optimism that buying interest may stay in the market in coming sessions.

The improvement in the MACD and the RSI back this view as well, though positive signals remain weak and fragile as the former has yet to show a sustainable increase above its 50 neutral mark and the latter to cross above zero.

Immediate resistance to additional upside corrections may appear around the 38.2% Fibonacci of 0.9000, while slightly higher, the area around the 0.9050 level may prove a tougher obstacle given the difficulty to successfully breach it in the previous year. If the latter appears easy to get through, cementing the upturn off the four-month low of 0.8785, traders could next look at the 23.6% Fibonacci of 0.9122.

Alternatively, should the price retreat below the 50% Fibonacci of 0.8897 and more importantly under the 20-day simple moving average (SMA), the 61.8% Fibonacci of 0.8796 will likely attempt to halt the bearish action. If not and the price drops under the 4-month low of 0.8785, then the sell-off may extend towards the 0.8675-0.8600 zone to probably find support at the lower line of the channel.

Meanwhile in the medium-term picture, the pair has returned to neutrality, though the falling 50-day SMA suggests that downside risks remain alive.

In brief, the short-term risk is tilted to the upside, though buyers would like to see a rally above 0.9050 to increase confidence in the ongoing upward move. In the medium-term, EURGBP is looking neutral but still exposed to downside pressures.