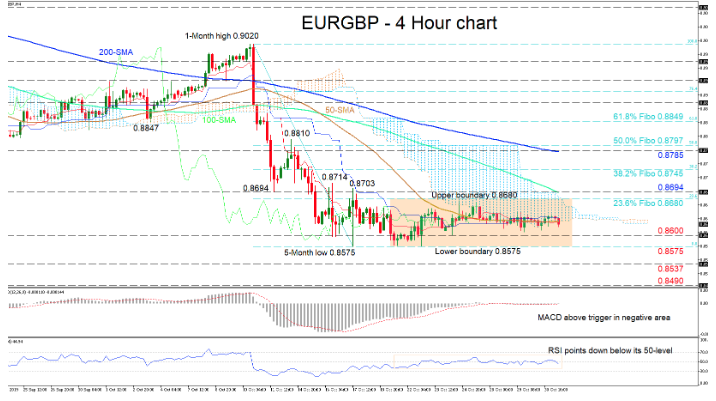

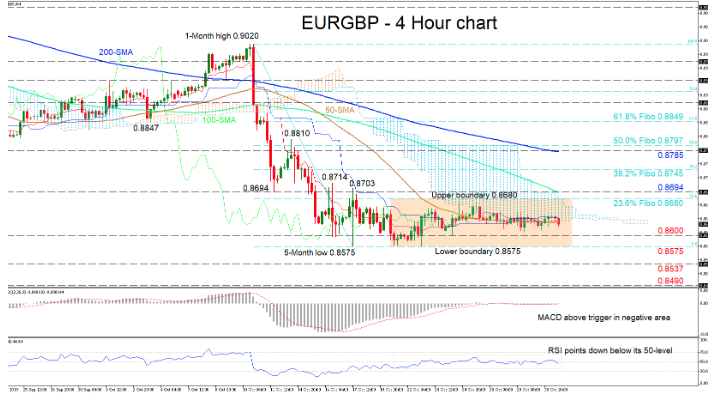

EURGBP’s directional momentum has evaporated after buyers brought the one week sell off to a halt at 0.8575 on October 17, shifting the pair into a sideways market that has lasted for two weeks. Despite this, the downward slopes in the 100- and 200-period simple moving averages (SMAs) support the existing negative sentiment as sellers are in the process of pushing below the 50-period SMA.

The mostly flat MACD near the zero line is barely above its red trigger line in the negative zone, while the RSI is reflecting a marginal increase in negative momentum, as it is pointing down slightly below its 50-neutral mark. The directionless market is also viewed in the flat 50-period SMA, Tenkan-sen and Kijun-sen lines.

With the restricting Ichimoku cloud, if the sellers manage to steer below the 50-period SMA, the 0.8600 support within the range could initially test declines, ahead of the lower boundary of 0.8575. Penetrating lower, the 0.8537 swing low from May 7 could apply some pressure before the 0.8490 trough from May 6 challenges the bears.

If buyers retake control ascending above the 50-period SMA and into the Ichimoku cloud, initial resistance could come from the upper boundary of 0.8680 — which also happens to be the 23.6% Fibonacci retracement of the down leg from 0.9020 to 0.8575. Slightly higher, the 0.8694 resistance fortified by the 100-period SMA and upper band of the cloud, could prove to be a tougher obstacle. Even higher, the 38.2% Fibo of 0.8745 could interrupt the test of the area of 0.8785 – 0.8797 where the 200-period SMA and 50.0% Fibo reside.

Overall, the short-term bias is neutral and a break below 0.8575 or above 0.8680 would reveal the directional bias.