- Renewed trade optimism and fading impeachment concerns lift dollar & stocks

- One of the ECB’s biggest hawks resigns; Draghi speaks today

- RBNZ Governor plays down prospect of QE, lifts kiwi

Dollar and equities shoot up as Trump says a trade deal may be close

Global risk sentiment improved drastically on Wednesday, as a combination of optimistic trade remarks and diminishing fears of a US presidential impeachment saw investors rotate back into riskier assets. The market’s mood started to improve after the White House released the transcript of a call between Trump and Ukrainian President Zelensky, which was not exactly the ‘blazing gun’ that the Democrats were looking for.

It showed that while Trump did ask for an investigation into the dealings of his political rival, Joe Biden, he did not ‘strong-arm’ Zelensky into doing so. The US Justice Department concluded that Trump did not violate any campaign finance laws, which soothed investors. A few minutes later, Trump stated that a trade deal with China may happen “sooner than you think”, playing up hopes for a breakthrough at the October talks in Washington.

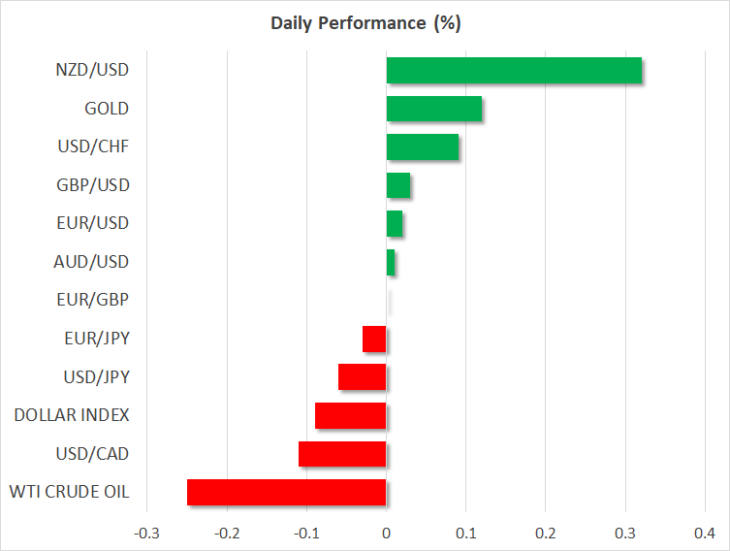

The dollar was by far the best performer in the FX arena, drawing strength from a surge in US bond yields as the improved trade outlook saw the odds of another Fed rate cut in October decline. Adding fuel to that move, were some remarks by Chicago Fed President Evans, who said that he does not foresee another cut this year. Since he is one of the biggest doves in the Fed, his ‘hawkish-sounding’ comments likely came as a surprise.

Overall, the outlook for the dollar remains positive ahead of the talks, which are currently expected on October 10-11, as both Washington and Beijing may continue to fuel hopes for progress. Indeed, this has been a consistent pattern before the last few rounds of negotiations, so both the greenback and equities may log some gains over the next couple of weeks. That said, the likelihood of even a ‘limited’ deal in October seems quite low, not least because China is unlikely to agree to anything unless the US rolls back all its tariffs. As such, markets may be left sorely disappointed in the end.

We will hear from a chorus of Fed officials today, including from Kaplan (13:30 GMT), Bullard (14:00 GMT), Daly (15:45 GMT), and Vice Chairman Clarida (15:45 GMT).

ECB hawk Lautenschlager resigns

In Europe, a noteworthy story was that ECB Executive Board member Sabine Lautenschlager announced her resignation, effective October 31. She was among the most hawkish policymakers, and firmly opposed the stimulus package that the central bank delivered a few weeks ago. The implication for monetary policy is that the ECB board may become even more dovish, given that one of the ‘arch-hawks’ is leaving.

Today, we will hear from ECB President Draghi (13:30 GMT) and Vice President de Guindos. For the euro, the technical picture is particularly interesting, as euro/dollar is now either setting up for a dip to fresh multi-year lows, or for a triple bottom formation and a reversal higher.

RBNZ Governor lifts the kiwi

Overnight, RBNZ Governor Orr gave the kiwi a boost, by playing down the possibility of Quantitative Easing (QE) in New Zealand. He also suggested that there’s a strong fiscal impulse already underway, which may be a hint that monetary policy does not need to be as aggressive. Hence, the odds of another rate cut in November dropped somewhat, though markets still view that as a coin flip.