If we take a peek at the global economy – the situation continues to look a little bit scary. All central banks continue to devaluate their national currencies facing the decreasing of inflation. No wonder that the word ‘crisis’ becomes more and more popular. We are not going to speculate on this topic, but we would like to remind that ‘self-fulfilling prophecy’ is one of the main market engines. In a nutshell – the main idea on the market is to follow the main tendency till the majority believes in it.

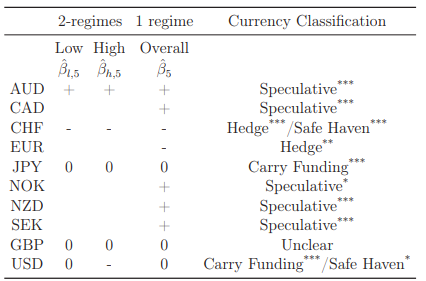

Switzerland’s national currency is traditionally considered as a ‘Save haven’ asset and the vast majority of traders may look at it as a way to avoid high risks. One of the most famous research on this topic was made by Bundesbank, that covered the period from March 1986 till September 2012 and showed that the Swiss franc usually rises, while a global stock market index is falling down.

Bundesbank concluded: ‘our results suggest that the CHF clearly qualifies as a safe haven currency since its returns are negatively related to global stock market returns in times of high financial stress’. Thus, we assume that Swiss franc may look much more preferable if the market starts increasing the probability of future global recession.

On Thursday 19-th the Swiss national bank was taking the decision about the interest rate. The regulator decided to leave the interest rate at the same -0,75% level. In the statement SNB stated the following: ‘risks to the global economy remain tilted to the downside. Chief among them are still political uncertainty and trade tensions, which could lead to renewed turbulence on the financial markets and a further dampening of economic sentiment. The Swiss economy continued to grow at a moderate rate in the second quarter’. SNB sees imbalances on the mortgage and real estate markets – it expects that prices may correct.

As well as other central banks SNB revised the economy growth downwards and expects growth of between 0,5% and 1% for 2019.

The main trading partner for Switzerland is Germany (15,3% of Switzerland’s total export). The United States and China are on the second and the third place. Unfortunately, for Swiss economy – it won’t be possible to avoid deceleration. What is really disturbing is that gems and precious metals take about 26,2% of the whole export and we assume that these items may be at high risk in case of global crisis.

Comparing AUD and CHF Switzerland’s currency will look more attractive in a long-term period. Also Australia’s interest rate is on 1% as a result RBA has room for further Monetary weakening.

Technically, after reaching its resistance line Australian currency started falling down. Indicators are giving reversal signals: MACD line broke the signal one, the price broke 9-EMA down. Williams %R reversed and started returning back into its normal position. The first serious target for the price may become 0,66000.

Read more

https://fortraders.org/en/forex-education/what-are-bid-and-ask-prices-in-forex-trading.html

https://fortraders.org/en/forex-education/what-is-time-frame-means.html