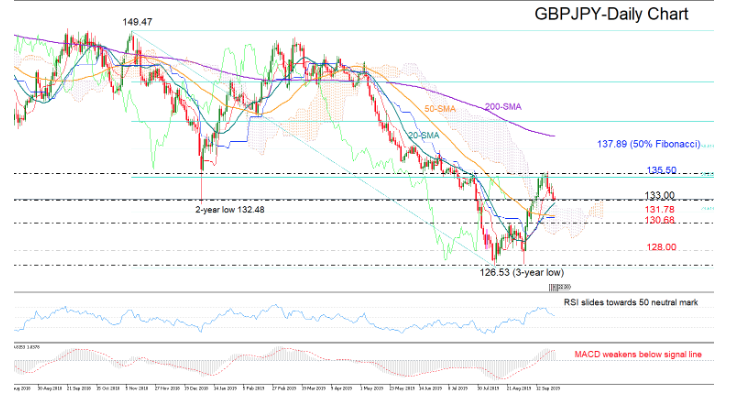

GBPJPY has been drifting below two-month highs after failing to close above the 135.50 resistance area.

The pair could follow a neutral-to-bearish direction in the short-term as the RSI is sloping downwards to meet its 50 neutral mark and the MACD is extending negative momentum below its red signal line.

Yet, the price continues to trade above its 20- and 50-day simple moving averages (SMAs), which recently posted a bullish cross, and higher than the Ichimoku cloud, providing hope that any downside may appear temporary.

On the way down, the 23.6% Fibonacci of 131.78 of the downleg from 149.47 to 126.53 could initially halt selling pressure. However, only a significant breach of the 130.68 restrictive zone could eliminate hopes of an upside reversal, shifting attention towards the 128.00 number, while lower, the bears would push harder to clear the 126.53 base.

Alternatively, if the 133.00 mark manages to pause the bearish action, the price could retest resistance within the 135.00-135.50 zone, where the 38.2% Fibonacci is also placed. Clearing that region, the bulls would next aim for the 50% Fibonacci of 137.89, a break of which could cement the rebound from three-year lows. Such a rally would also change the bearish medium-term outlook to a bullish one.

In short, GBPJPY is expected to face a neutral-to-bearish bias in the short-term, while in the medium-term, the outlook is likely to hold negative unless the market improves above 137.89.