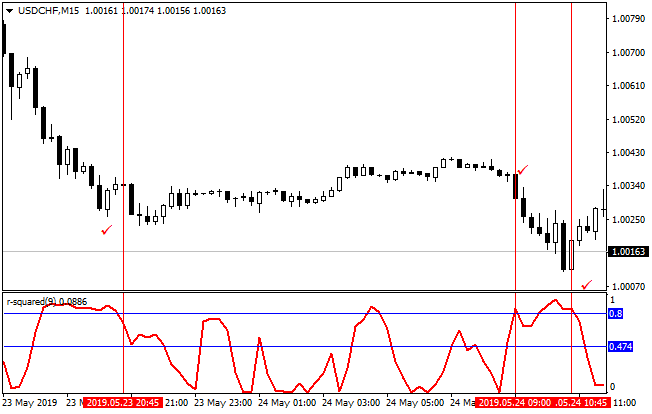

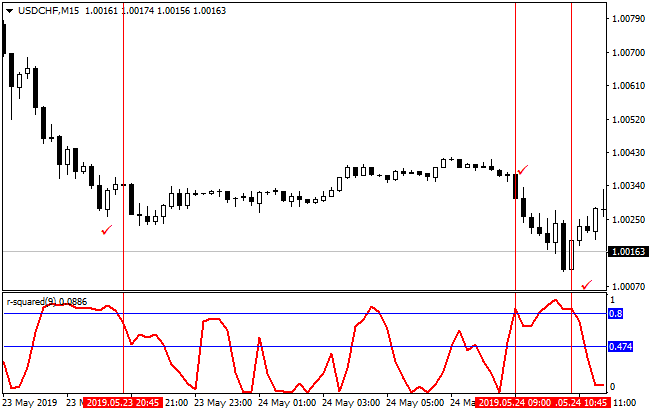

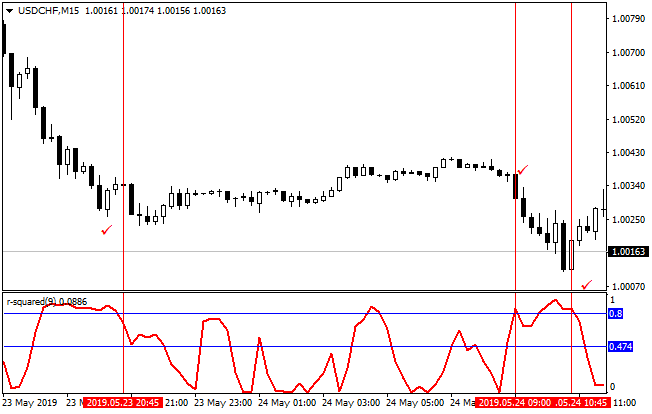

Good indicator to determine the trend reversal or end. When red line cross level 0.8 down, it’s a signal of trend reversal. Signal is worse on flat period.

- Pairs: any

- Timeframe: any

Download

- indicator r-squares [mt4]

Good indicator to determine the trend reversal or end. When red line cross level 0.8 down, it’s a signal of trend reversal. Signal is worse on flat period.

You can use the AFIRMA indicator in strategies as a trend indicator or as a confirmation of the traditional Moving Average signals. It works without delay. The AFIRMA indicator is a long–developed indicator that has not lost its relevance, predicting the movements of quotations well. It looks like a moving average, but the main difference […]

HMA Color is improved variant of moving average that displays the direction of the current trend. Green color of forex indicator means uptrend, red – downtrend. Indicator is better when the market is in trend, because is does not displays flat. So it is good in pair with the oscillator. Also the strategy of three […]

DCE on SMMA or Dynamic Cycle Explorer of averages is an indicator that displays cyclical dynamics of moving average. In fact, this Forex filter is represented by trend indicator, placed in a separate field and demonstrating the direction of the current movement on the market. Obviously, it is needed to configure each separate currency pair […]

MA_3TF_VS is a comfortable variation of moving average for trading on Forex. It represents three lines, based on the data of three timeframes, which must be inputted in the settings. Crossings of the highest timeframe’s average with other MA lines and the price is the strongest signal for this indicator. The stronger the lines diverge […]