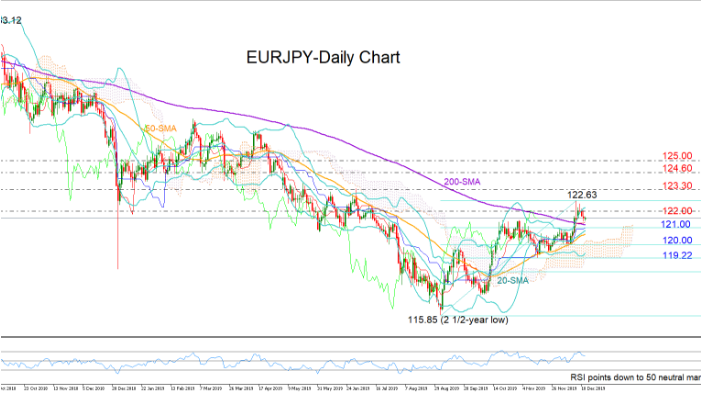

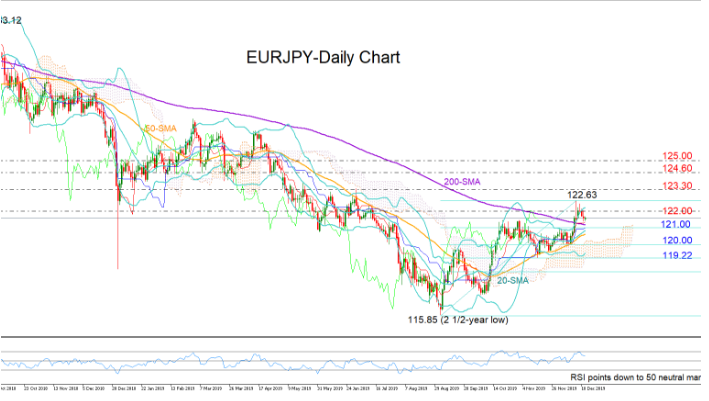

EURJPY managed to run above the 200-day simple moving average (SMA) for the first time in more than a year and formed another higher high at 122.63 last Friday.

The market, however, soon reached overbought conditions as reflected by the RSI, which is moving towards its 50 neutral mark after hitting the 70 level. The price reversal near the upper Bollinger band and the doji created at the top of the uptrend add to the short-term discouraging signals.

Still, traders will be waiting for a closing price below the 200-day SMA and particularly below the 121.00 level, where the 23.6% Fibonacci of the upleg from 115.85 to 122.63 is located, before becoming more cautious on the positive outlook. Such a move could potentially enhance the selling pressure probably towards the 38.2% Fibonacci support mark of 120.00, a break of which could see a test of the 50% Fibonacci of 119.50 and the bottom of the Ichimoku cloud.

In case of a rebound, the bulls should reclaim the 122.00 number and rally above the 122.63 peak to extend the rally up to the 123.30 resistance. Surpassing the 124.30 former support area too, the next stop could be somewhere near 125.00.

Meanwhile, the medium-term outlook remains positive given the higher highs and higher lows since the end of August and the rising 50-day SMA. A break below 120.00 would put the market back on the neutral path.

Summarizing, EURJPY is experiencing downside pressures though only a decisive close below 121.00 would discourage short-term buyers, while a decline below 120.00 is required to turn medium-term traders cautious as well.