On Monday afternoon, the major currency pair continues consolidating around 1.1215 after having hard times the week before.

Some believe that all these general expectations of a possible benchmark rate cut by the US Federal Reserve in the nearest future are nothing but speculations, but there is something in what they say. On one hand, the numbers published by the USA are rather mixed (it happens from time to time) and the Retail Sales report managed to balance the situation after weak reports on the labor market released last week. On the other hand, the USA started global trade wars, which aren’t too widespread right now, but may escalate at any moment.

To stand against China, Mexico, and other countries, the USA will need an “ultrasoft” monetary policy inside the country to help them prevent the country’s economy from slowing down. That’s the reason why market players are discussing a possible decrease of the rate.

It is evident that the Fed is not going to cut the rate this week and the regulator will be very careful about commenting it. Frankly speaking, the more careful the Fed, the better for the USD.

EURUSD: tehnical forecast

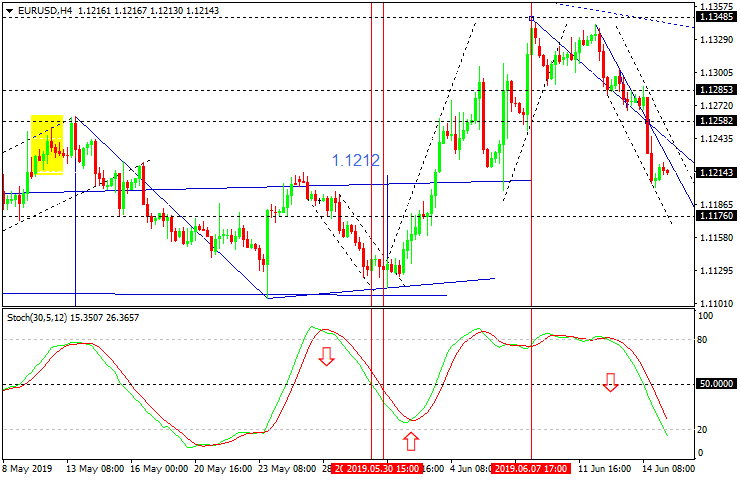

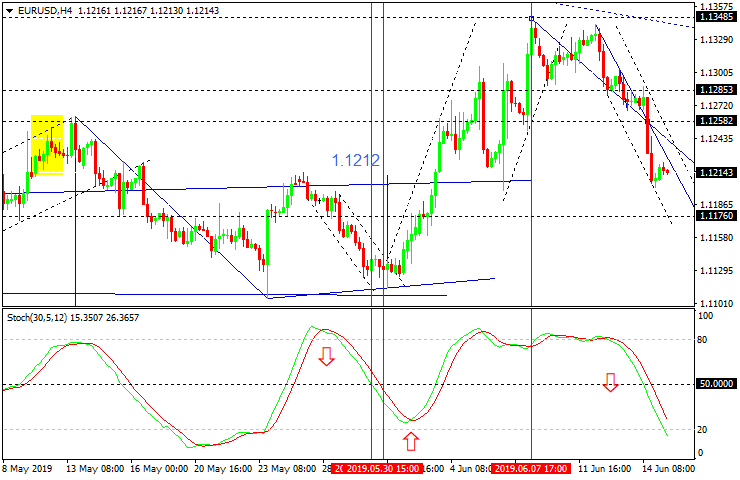

As we can see in the H4 chart, EURUSD is forming the second descending impulse; it has already reached the predicted downside target at 1.1212 and right now is consolidating near the lows. Possibly, the pair may start a new correction towards 1.1258 and then resume trading downwards to reach 1.1170. . From the technical point of view, this scenario is confirmed by Stochastic Oscillator, as its signal line is moving to the downside. After entering the “oversold area”, the price may start consolidating.

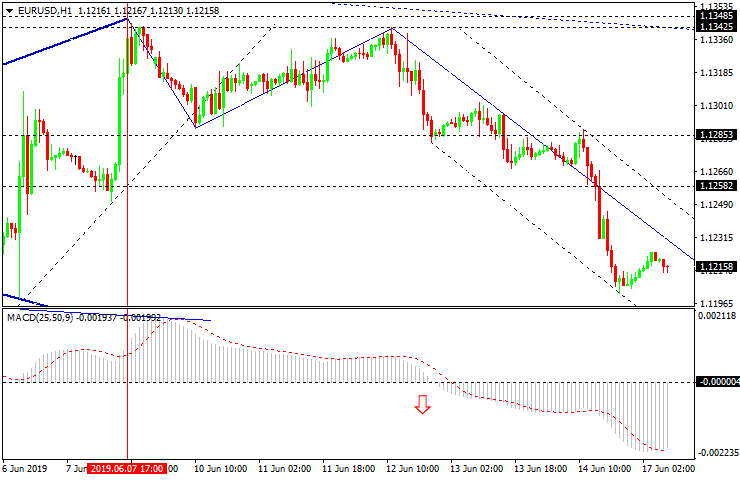

In the H1 chart, the pair is trading downwards; it has broken 1.1258 and may continue the downtrend. The key downside target is at 1.1170. Considering the nature of third waves, there might be corrections, but only as an alternative scenario. The main scenario remains the same and implies that the instrument may fall to reach the above-mentioned target. From the technical point of view, this scenario is confirmed by MACD Oscillator, as its signal line is moving below 50, thus indicating further decline.