Early in the second week of July, EURUSD is reaching stability at 1.1225.

June numbers on the US labor market were unimpressive. The Unemployment Rate went from 3.6% in May to 3.7% in June; the Average Hourly Earnings added 0.2% m/m instead of 0.3% m/m (forecast). The Non-Farm Employment Change, which showed 224K, managed to smooth the situation a bit and save the USD. However, it seems as if the employment market is approaching some kind of critical time.

There will be few numbers significant to the European currency early in the week. On Monday morning, Germany reported on the Industrial Production, which added 0.3% m/m in May after losing 2.0% m/m in the previous month – it’s not even a rebound yet, but just a slight correction. There aren’t enough new orders to stabilize the sector. In the afternoon, Germany will publish the Sentix Investor Confidence for July. According to market expectations, the indicator may add 0.3 points after showing -3.3 points in June. This information is rather minor for EURUSD and investors aren’t expected to respond vividly.

The thing worth paying attention to this week is the speech to be delivered by the US Federal Reserve Chairman Jerome Hayden Powell. In anticipation of the July meeting, he may speak about the regulator’s monetary policy and provide some hints at its further plans on the benchmark rate.

Apart from this, the USA are scheduled to report on the Consumer Price Index this week, which is expected to slow down and remain unchanged in comparison with its previous reading. That’s not a good signal. The Fed might perceive the inflation slowdown as an indication to cut the rate.

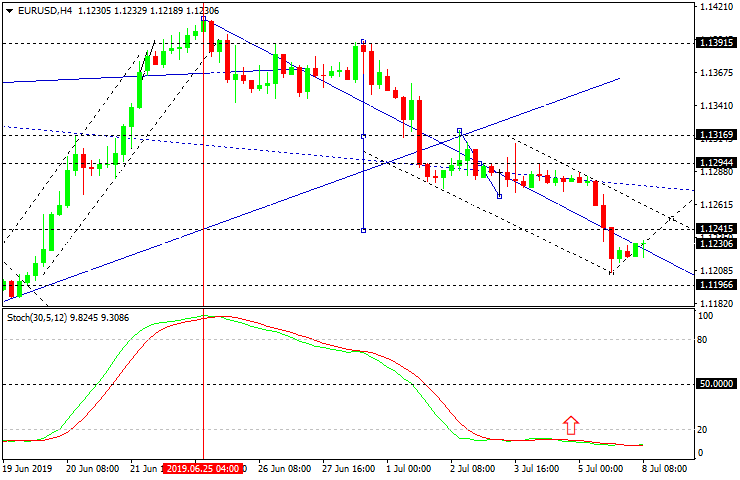

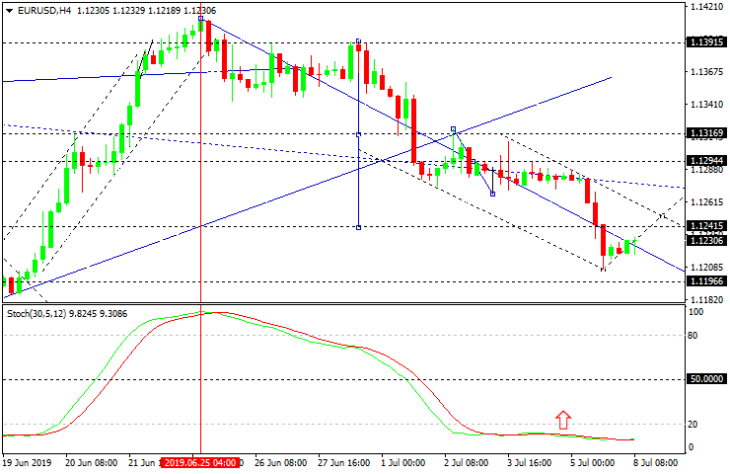

EURUSD

As we can see in the H4 chart, EURUSD has reached the target of the third descending wave; right now, it is trading upwards to reach 1.1242. After that, the instrument may start a new decline towards 1.1222, thus forming a new consolidation range between the above-mentioned levels. If later the price breaks the range to the upside, the instrument may continue the correction with the target at 1.1290; if to the downside – form a new descending structure towards 1.1200 and then resume trading upwards to reach the target. From the technical point of view, this scenario is confirmed by Stochastic Oscillator, as its signal is moving inside the “oversold area”. To confirm a new rising wave, the indicator must break the area upwards.

In the H1 chart, EURUSD is trading upwards with the first target at 1.1245. Later, the market may fall towards 1.1222 and then form one more ascending structure to reach 1.1290. From the technical point of view, this scenario is confirmed by MACD Oscillator, as its signal line is no longer trading close to the lows, thus indicating a potential rising movement. The divergence on MACD is another confirmation of this scenario.