The British Pound stopped falling on Monday, November 11th, but investors aren’t too optimistic.

Last week, the Bank of England had another meeting, which wasn’t expected to provide any surprises. The key rate was left intact, just as expected. However, this time two out of nine members voted for cutting the rate by 25 basis points for the first time since 2016. Among valid arguments in favor of loosening the regulators’ monetary policy were a dim economic outlook and a possible weakening of the employment market.

According to market expectations, which were revised downwards, the GDP growth in 2020 maybe +1.2% and that’s the lowest number over the previous 10 years. However, the BoE believes that later everything will be fine: the regulator’s fiscal policy will be supportive, uncertainty regarding the Brexit will go, and the global economy will improve a little bit.

Still, all this can’t make the Pound happy right now, because the Brexit drama continues and the country’s economy gives more and more signals that it’s not okay.

Technical forecast

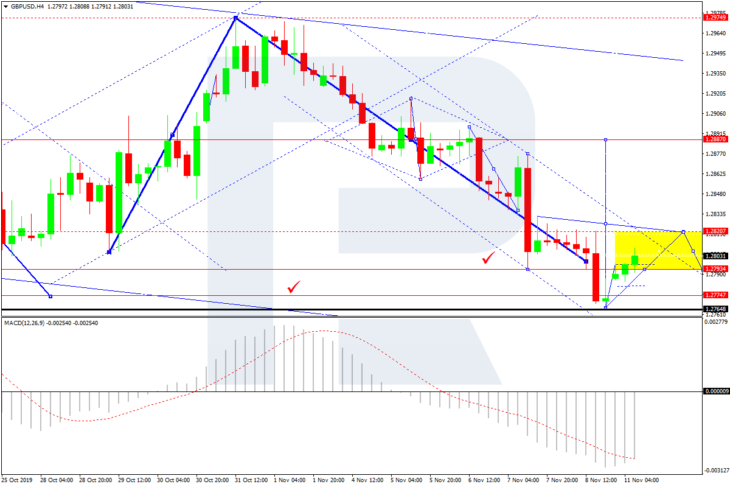

As we can see in the H4 chart, GBP/USD has reached its downside target; right now, it is moving upwards. Possibly, the pair may form a new impulse towards 1.2828 and then start another correction to reach 1.2772. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is ready to grow and reach 0. After breaking it, the price may continue growing.

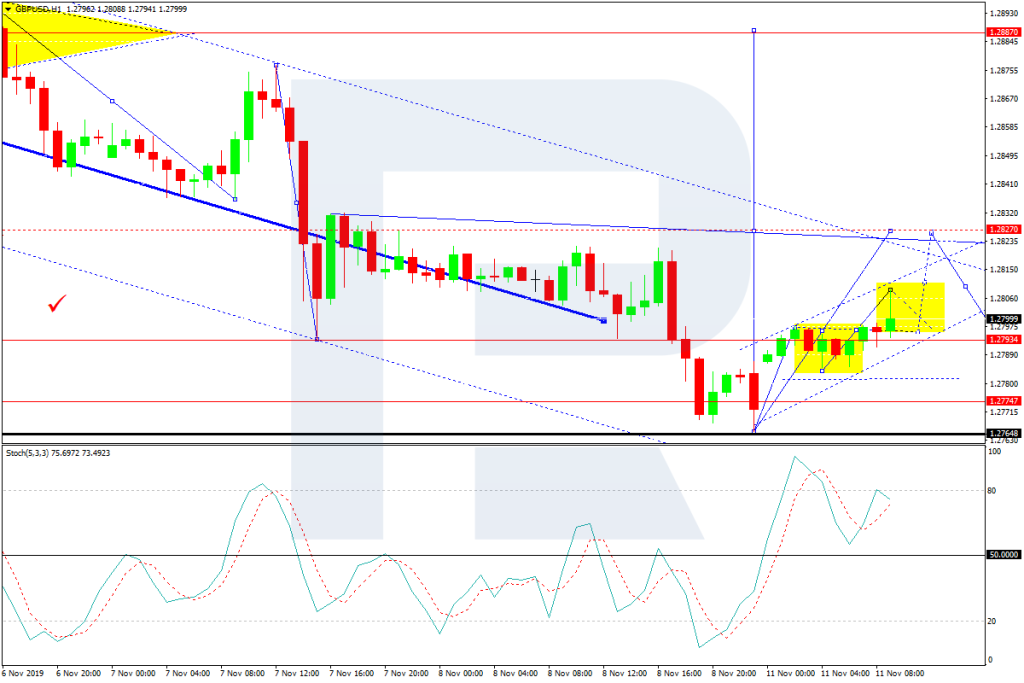

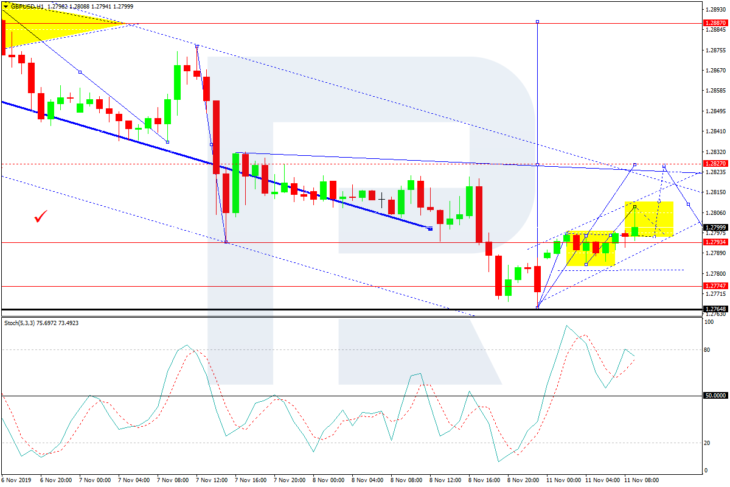

In the H1 chart, GBP/USD is moving upwards. Possibly, today the pair may form a new descending structure towards 1.2796 and then start another to reach 1.2828. Later, the market may consolidate at these highs. If later the pair breaks this range to the downside, the instrument may start a new correction with the first target at 1.2800. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is about to leave the area above 80. Practically, the indicator suggests that the instrument may reach the closest target of the descending structure.