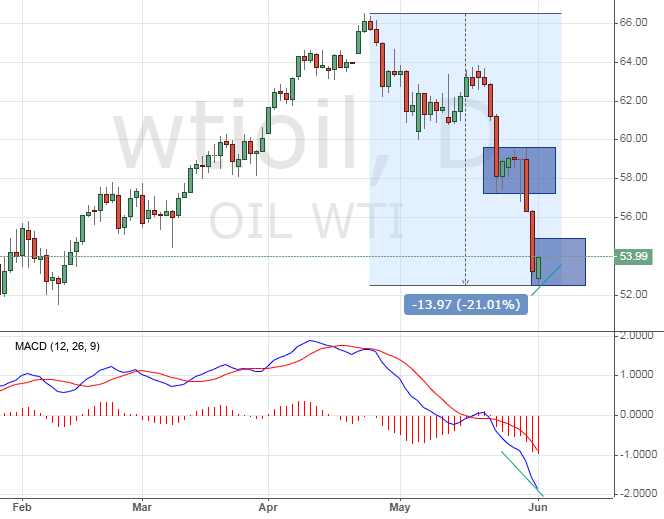

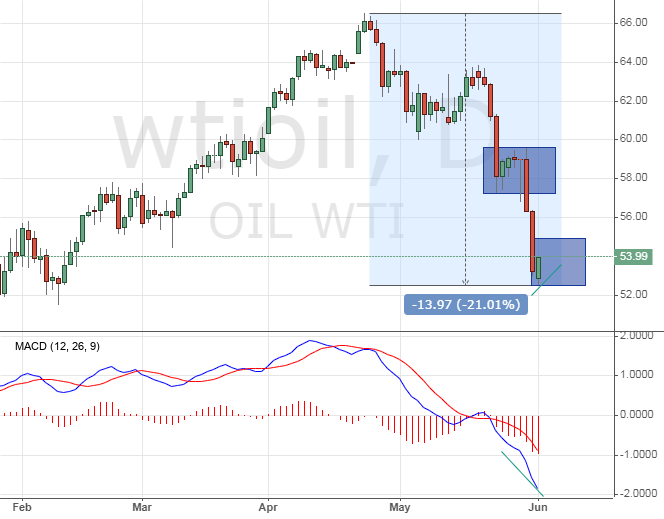

Oil prices extended losses on Monday in Asia After a 3% slump last Friday amid tension between Mexico and the U.S.

U.S. Crude Oil WTI Futures was down 1.1% to $52.91 by 12:20AM ET (04:20 GMT). International Brent Oil Futures fell 1.4% to $61.12.

Oil markets lost about 3% on Friday after Trump vowed to impose a tariff on all goods coming from Mexico, starting at 5% and ratcheting higher until the flow of people ceases.

«Oil prices slid on fresh trade worries after U.S. President Donald Trump stoked global trade tensions by threatening tariffs on Mexico, which is one of the largest U.S. trade partners and a major supplier of crude oil,» said Mithun Fernando, investment analyst at Australia’s Rivkin Securities, in a note that is cited by Reuters.

For the month, The WTI lost 16% while the Brent 11%, recording the worst monthly losses in six months.

Tariff on Mexican imports, larger-than-expected crude inventories data, and an escalating trade war between the U.S. and China were all cited as catalysts for the selling in oil prices.

The American Petroleum Institute will release its weekly report on oil stockpiles on Tuesday, while the EIA is due to publish its report the following day.