At the beginning of another September week, EURUSD is consolidating around 1.1072.

Almost all traded currencies are quite neutral while the entire financial world is following the events on the oil market. However, this week there will be triggers for the major currency pair to respond to, that’s why all activities are obviously ahead.

On Wednesday, September 18th, the meeting of the US Federal Reserve will be over, where the regulator is expected to announce its rate decision. Market players are expecting the Fed to cut the rate by 25 basis points this month and by the same amount during its December meeting. After that the regulator may take a long pause in order to closely follow the progression of events.

In theory, the American economy in its current state, which is quite good by the way, doesn’t need this support and stimulus. But in fact, the regulator has no choice – the White House’s pressure is too great.

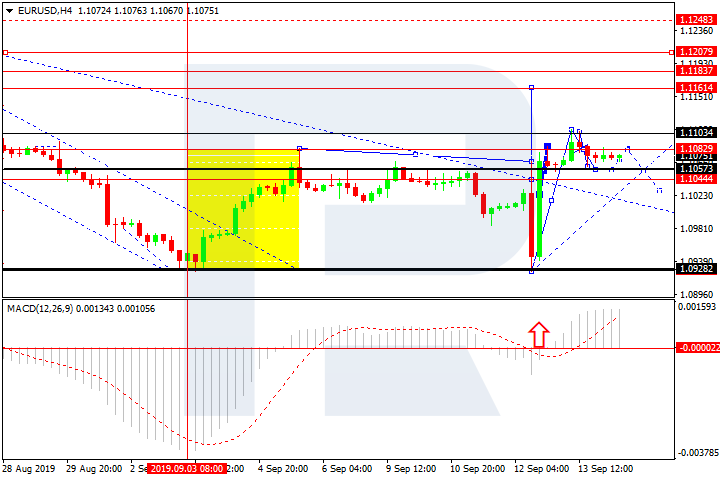

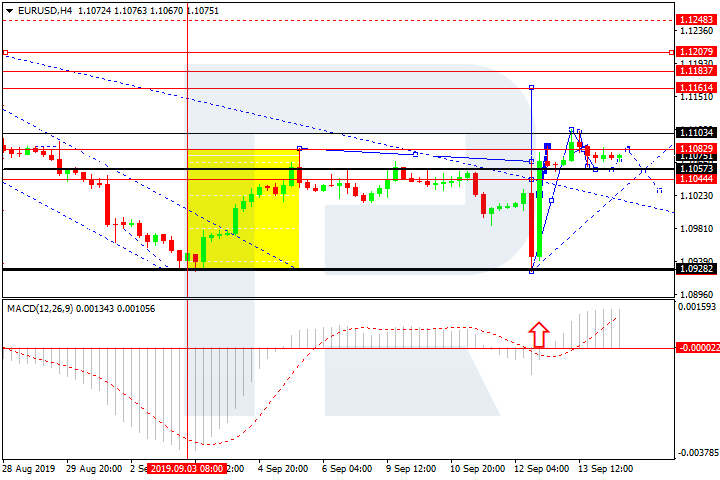

Technically

In the H4 chart, EURUSD is moving upwards; it has formed another consolidation range above 1.1057, which may be considered as an upside continuation pattern. After breaking 1.1110 upwards, the instrument may continue growing to reach 1.1160, at least. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal is moving directly upwards above 0, thus confirming the further uptrend.

As we can see in the H1 chart, EURUSD is consolidating around 1.1083. Possibly, the pair may form another descending structure to reach 1.1057 and then return to 1.1083. After breaking this level, the price may continue growing towards 1.1110. If this level is later broken as well, the growth may continue to reach 1.1200. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving directly upwards from 20. After breaking 50, the indicator may boost to reach 80.