Early in another November week, the major currency pair continues growing, but due to the lack of news on the US-China trade agreement, the dynamics are pretty slow.

Both the USA and China mentioned on several occasions that they might sign the first phase of their trade agreement in the nearest future, but they never got to first base. Policymakers keep saying that the agreement is right around the corner, but that’s it. In fact, both parties were talking about being ready to sign the document may months ago, so one can say that nothing really changed.

Those numbers from China that were published last week might have been the driver to push the talks, as they showed that the Chinese economy was not doing very fine. However, last weekend it became known that the People’s Bank of China has intentions to continue restraining inflation and stimulate external demand, thus cushioning the consequences of global trade wars. It means that the Chinese regulator does have tools and resources to help the economy while the parties continue negotiating.

By the way, numbers from the USA on the Retail Sales rang alarm bells as well. For example, the components of the report showed that consumers reduced their spending on furniture, restaurants and bars, electronics and appliance, clothing and footwear, which may signal their readiness to save money.

This week, the US Federal Reserve is scheduled to publish the FOMC Meeting Minutes, where investors may try to find details or hints at further activities. This particular time, the question is whether the regulator is going to cut the rate in December or tries to avoid it.

EURUSD on charts

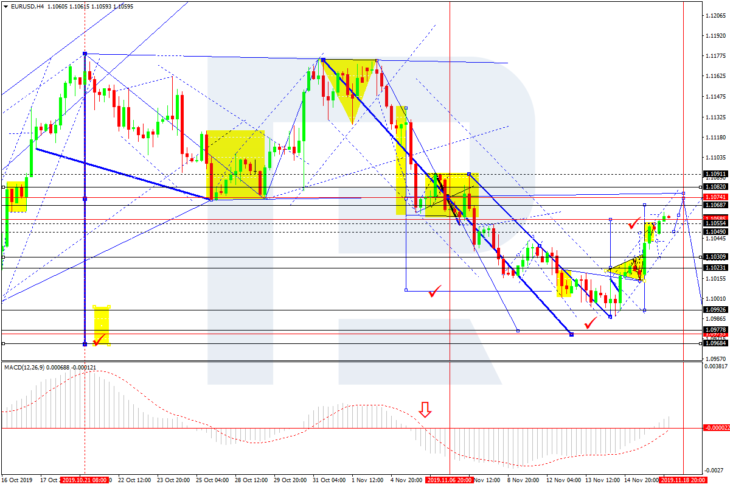

As we can see in the H4 chart, EUR/USD has reached the closest correctional target at 1.1055; right now, it is moving upwards and may extend this rising structure towards 1.1068. After that, the instrument may start another towards 1.1030, thus forming a new consolidation range at the current highs. If later the pair breaks this range to the upside, the instrument may resume growing towards 1.1074; if to the downside – continue the downtrend to reach 1.0977. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is getting close to 0, thus confirming consolidation.

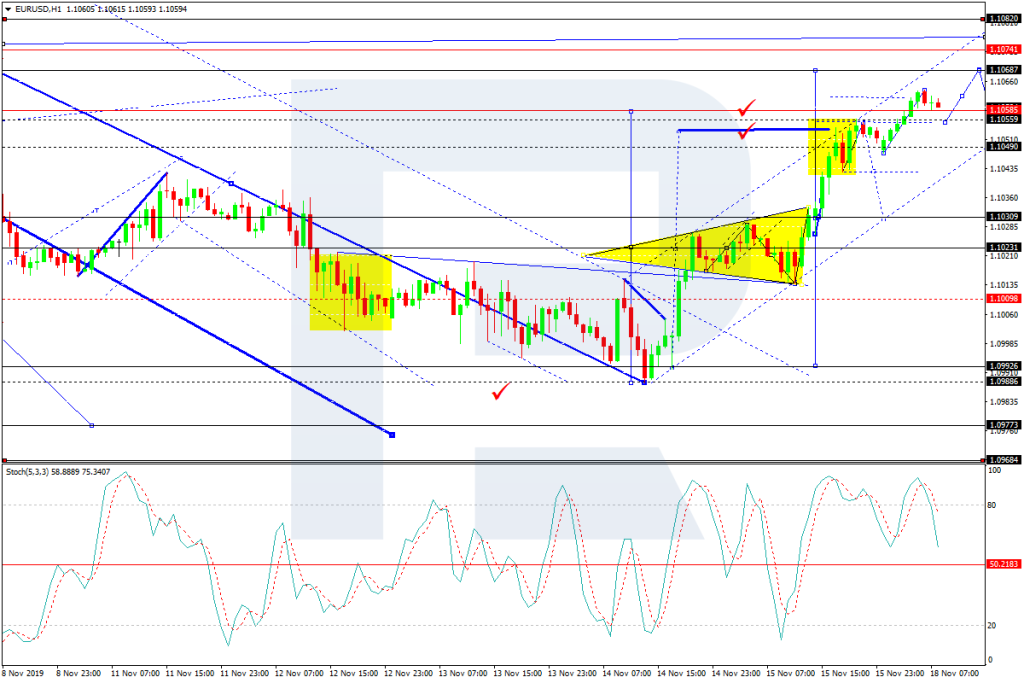

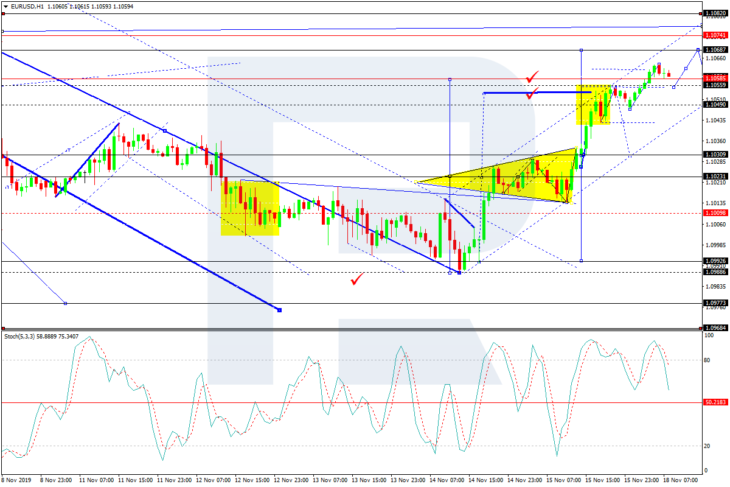

In the H1 chart, after completing another ascending structure, which may be considered as correction, EUR/USD is consolidating around 1.1050. by now, it has already expanded the range up to 1.1063. Possibly, the pair may form a new descending structure towards 1.1055. If later the pair breaks this range to the upside at 1.1063, the instrument may continue growing to reach 1.1068; if to the downside at 1.1050 – resume trading downwards with the target at 1.1030. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is falling towards 50. Breaking it to the downside will confirm further decline in the direction of 1.1030.