The key catalyst for buyers right now is optimism in trade talks between the USA and China. Bloomberg reported yesterday that “China said it will raise penalties on violations of intellectual property rights.” This was one of the most topical issues in US-China trade wars and market players liked that China was ready to meet the USA halfway when it comes to IP theft.

As a matter of fact, absolutely nothing changed, that’s why oil prices remain highly volatile so far.

The latest numbers from Baker Hughes showed that the Rig Count in the USA has been decreasing for the fifth consecutive week. The Oil Rig Count lost 3 units and now equals to 671. The Gas Rig Count didn’t change.

Brent technically

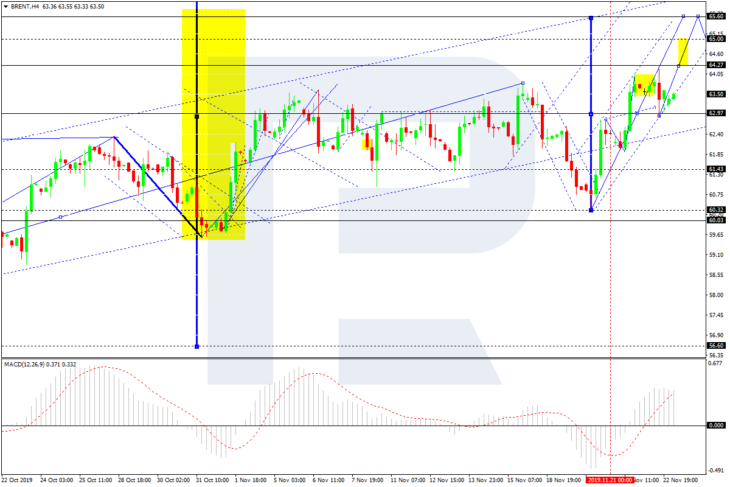

As we can see in the H4 chart, after breaking 63.00 to the upside and reaching 63.95, Brent has completed the correction to return to 63.00; right now, it is moving upwards to reach 64.25. if later the price breaks this level, the instrument may continue growing with the first upside target at 65.50. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0, thus indicating further growth.

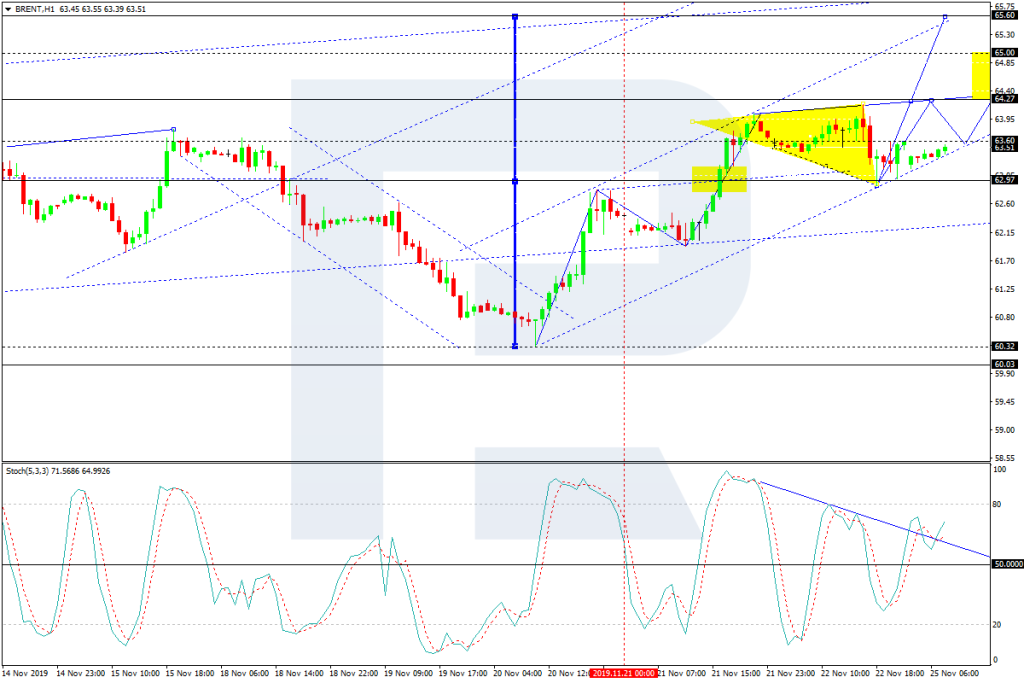

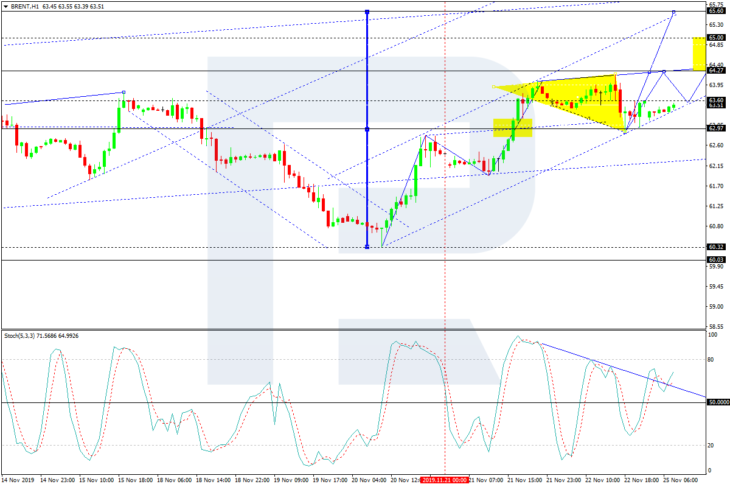

In the H1 chart, Brent is consolidating in the center of the range around 63.60. According to the main scenario, the price is expected to expand the range towards 64.25 and then form a new descending structure to reach 63.60. Later, the market may resume growing with the target at 65.00. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving above 50, thus directly indicating further growth.