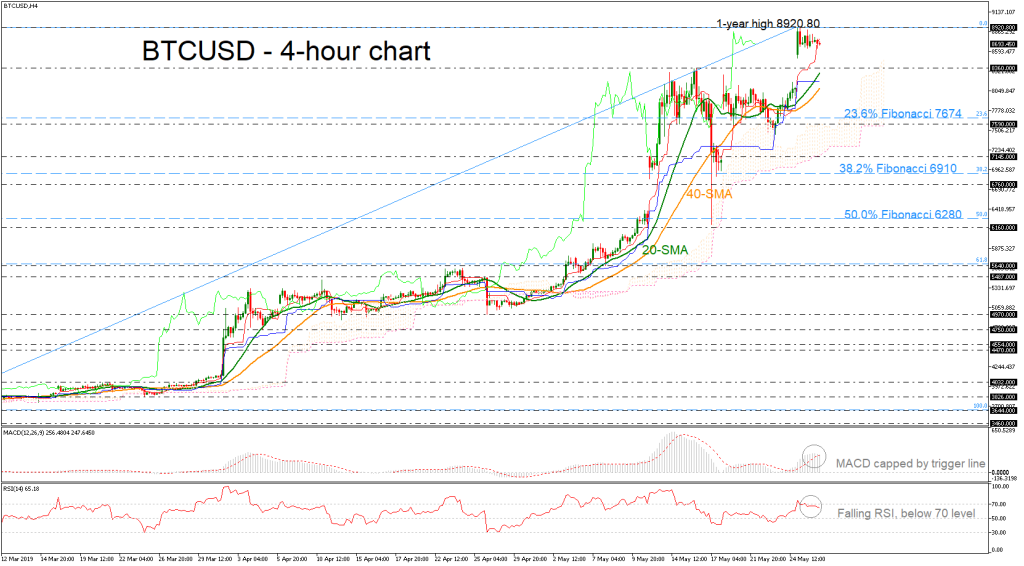

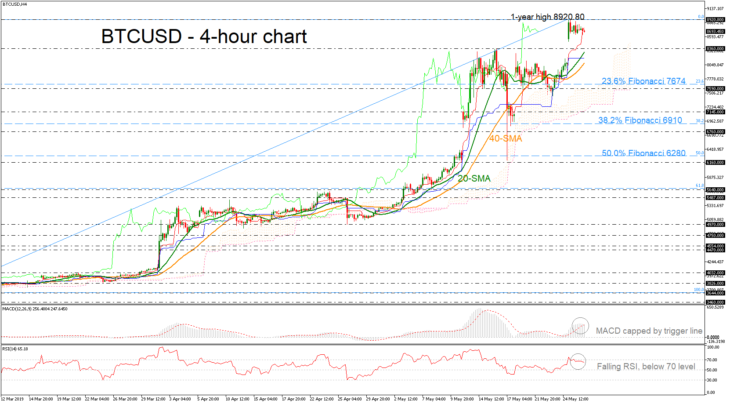

BTCUSD is declining after the sharp buying interest towards the one-year high of 8920.80 on Monday. Looking at momentum indicators, the RSI is lacking direction slightly below the threshold of 70, suggesting that the market could return lower in the near term. The MACD also supports this view in the positive territory and is currently embraced by its red signal line.

In case of further bearish action, immediate support is coming from the 8360 barrier, taken from the peaks on May 16. If there is a close below this level the bitcoin could find obstacle at the 20- and 40-simple moving averages (SMAs) currently at 8316 and 8082 respectively in the 4-hour chart. The next level to have in mind is the 23.6% Fibonacci retracement level of the upward movement from 3644 to 8920.80, around 7674.

However, if prices are unable to post a negative correction in the short term, the outlook would shift back to the upside, with the one-year high of 8920.80 coming into focus again. Above this level, the next target could be faced near the 9367.50 resistance, registered on May 2018.

Briefly, in the medium-term, bitcoin has a strong ascending tendency over the last five months, however, it seems to be overstretched in the short-term, flirting with a downside retracement.